Jim Cramer believes that a consistent flow of trade agreements is crucial to bolstering market confidence and allaying fears of both recession and a surge in inflation.

What Happened: In a recent post on X, Cramer asserted that a “steady drip of trade deals” might be the key ingredient to sustain the current market momentum, particularly given the limited number of institutional investors holding bullish positions.

Cramer’s commentary underscores the market’s sensitivity to global trade dynamics and their potential impact on economic stability and price levels. The implication is that positive developments on the trade front could provide the necessary reassurance for investors, outweighing prevailing concerns about a potential economic downturn and escalating inflation.

In a subsequent post, Cramer also took aim at prominent bearish voices within the billionaire investor class. While not naming specific individuals in these recent posts, he emphasized the significant influence these figures wield and called for a change in their rhetoric. “

Cramer’s perspective suggests a delicate balancing act for the market. While positive trade developments could act as a vital catalyst for bullish sentiment and potentially ward off recessionary pressures, the pronouncements of influential bearish investors could introduce volatility and undermine confidence.

Why It Matters: U.S. and China agreed on Monday to temporarily reduce reciprocal tariffs on each other’s goods for 90 days, marking a considerable easing of trade tensions.

The recent tariff reductions between the U.S. and China echo a similar agreement reached with the U.K. last week, fueling optimism for a revival in global commerce and economic growth.

However, Cramer’s call for steady progress on trade deals is vital, as the temporary nature of this 90-day deal with China doesn’t give a long-term solution.

Despite the initial positive action following the announcement, John Murillo, the chief dealing officer at B2BROKER, emphasized, “Now, while the 90-day pause is a big step towards easing tensions, it’s crucial to remember that it doesn’t guarantee a complete resolution of the trade war.”

Price Action: While the stocks rejoiced at the U.S.-China trade development on Monday, the SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust ETF QQQ, which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Tuesday. The SPY was down 0.22% to $581.70, while the QQQ declined 0.15% to $507.10, according to Benzinga Pro data. The S&P 500 futures were also trading lower on Tuesday morning.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

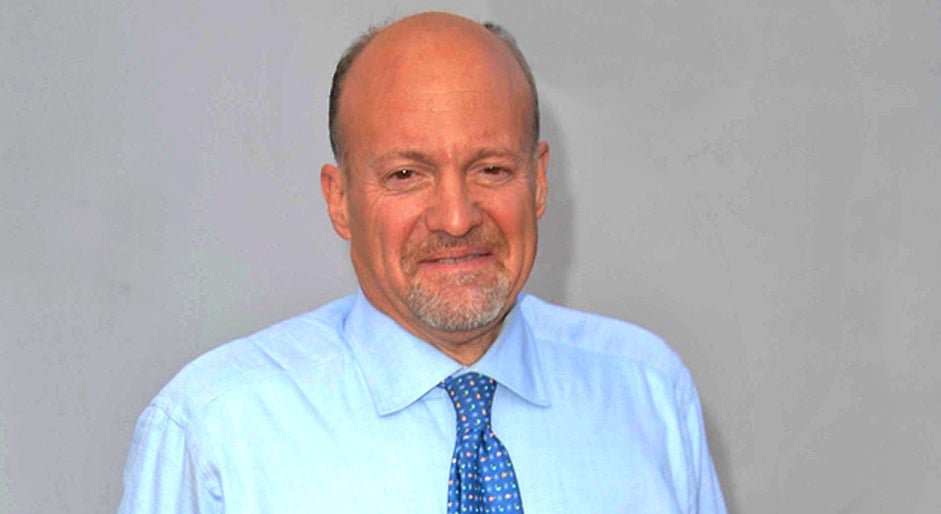

Photo: Shutterstock

Add Comment