Berkshire Hathaway Inc BRK BRK has silently emerged as one of the biggest players in the U.S. Treasury-bill market. In JPMorgan‘s estimation, Warren Buffett‘s conglomerate currently holds around 5% of all outstanding short-term government bills. This makes it the fourth-largest holder in the world.

What Happened: Berkshire’s T-bill holdings have increased to $314 billion as of the end of March, multiplying twofold in the past year, outpacing even the holdings of foreign banks, the Federal Reserve, Local Government Investment Pools, offshore money market funds, and stablecoin-backed reserves, according to JPMorgan, reported CNBC.

Buffett, regularly buys T-bills at weekly auctions, at times in $10 billion chunks. With short-term yields still more than 4%, the portfolio earns billions in interest income every year.

Why It Matters: During Berkshire’s recent annual meeting, 94-year-old Buffett reminded shareholders that cash has intrinsic strategic value: “Every now and then you find something and occasionally, very occasionally, but it’ll happen again… we will be bombarded with offerings that we’ll be glad we have the cash for.” He also shared that the company had almost spent $10 billion in the recent past but decided to hold back. “We came pretty close to spending $10 billion, not that long ago, for example, but we’d spend $100 billion” if the right deal came along, Buffett said.

At the same meeting, he also expressed concerns about the falling value of the United States currency. Earlier this month, Berkshire Hathaway reported a major drop in its operating earnings in the first quarter.

As he prepares to step down as CEO at the end of the year year — which led to Berkshire Hathaway stocks falling — the Oracle of Omaha leaves behind a company equipped with cash and patience, waiting for the next big elephant.

Read Next:

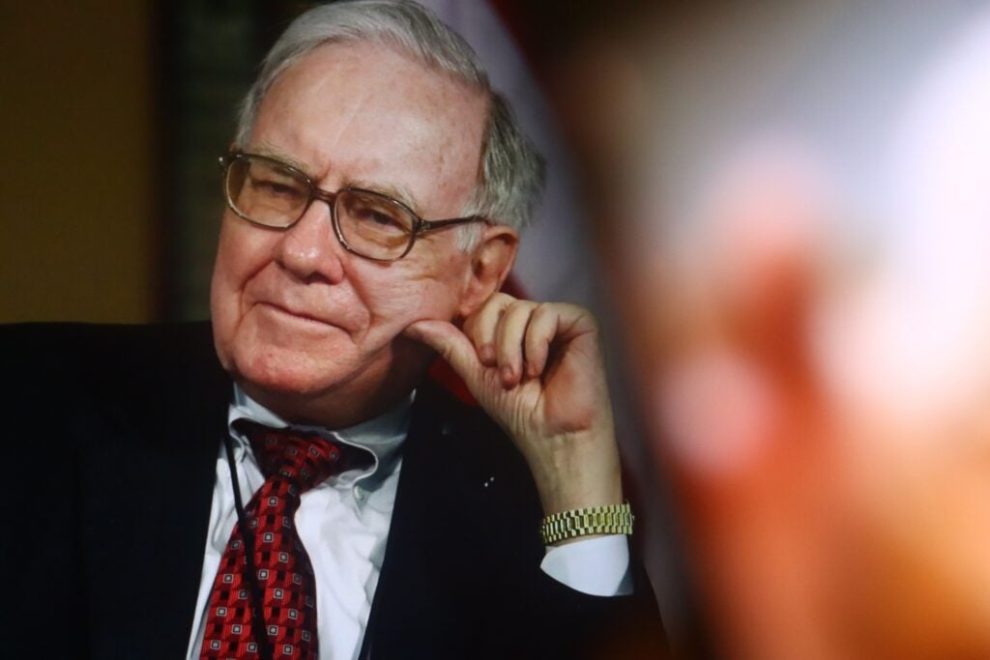

Image Via Shutterstock

Add Comment