Ribbon Comms RBBN is preparing to release its quarterly earnings on Tuesday, 2025-04-29. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Ribbon Comms to report an earnings per share (EPS) of $0.00.

Ribbon Comms bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

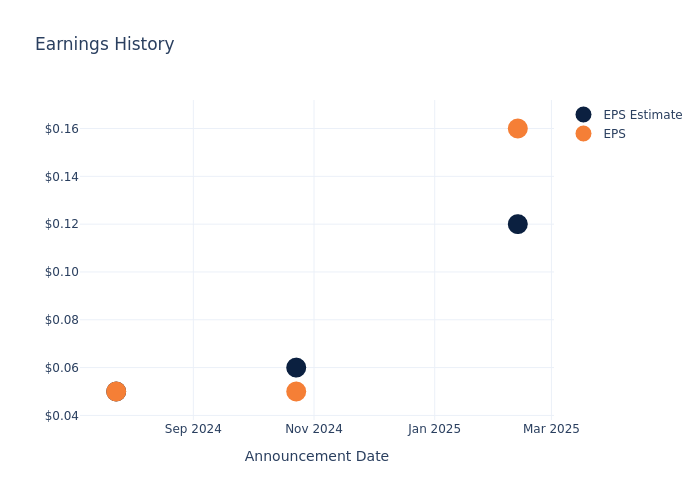

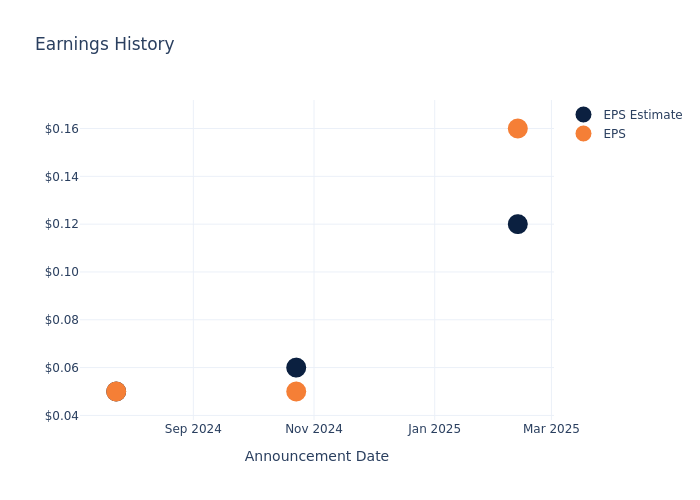

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.04, leading to a 15.47% increase in the share price the following trading session.

Here’s a look at Ribbon Comms’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.12 | 0.06 | 0.05 | 0 |

| EPS Actual | 0.16 | 0.05 | 0.05 | -0.01 |

| Price Change % | 15.0% | 8.0% | -17.0% | -0.0% |

Tracking Ribbon Comms’s Stock Performance

Shares of Ribbon Comms were trading at $3.61 as of April 25. Over the last 52-week period, shares are up 16.09%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Ribbon Comms

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Ribbon Comms.

With 1 analyst ratings, Ribbon Comms has a consensus rating of Outperform. The average one-year price target is $6.0, indicating a potential 66.2% upside.

Comparing Ratings with Competitors

The below comparison of the analyst ratings and average 1-year price targets of Adtran Holdings, Applied Optoelectronics and Netgear, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Adtran Holdings, with an average 1-year price target of $13.33, suggesting a potential 269.25% upside.

- Analysts currently favor an Buy trajectory for Applied Optoelectronics, with an average 1-year price target of $33.2, suggesting a potential 819.67% upside.

- Analysts currently favor an Outperform trajectory for Netgear, with an average 1-year price target of $29.0, suggesting a potential 703.32% upside.

Peer Metrics Summary

Within the peer analysis summary, vital metrics for Adtran Holdings, Applied Optoelectronics and Netgear are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ribbon Comms | Outperform | 11.02% | $140.07M | 1.59% |

| Adtran Holdings | Buy | 7.70% | $91.23M | -24.65% |

| Applied Optoelectronics | Buy | 65.87% | $28.73M | -54.26% |

| Netgear | Outperform | -3.32% | $59.38M | -1.63% |

Key Takeaway:

Ribbon Comms ranks at the top for Revenue Growth and Gross Profit among its peers. However, it ranks at the bottom for Return on Equity.

Discovering Ribbon Comms: A Closer Look

Ribbon Communications Inc provides network solutions to service providers and enterprises. The company enables service providers and enterprises to modernize their communications networks and provide secure real-time communications solutions to their customers and employees. The company has two separate lines of business; the Cloud and Edge segment, and the IP Optical Networks segment. The majority of the revenue for the company is generated from its Cloud and Edge segment that provides secure and reliable software and hardware products, solutions, and services for VoIP communications, Voice Over LTE among others to service providers and enterprise customers. The company generates majority of its revenue from United States.

A Deep Dive into Ribbon Comms’s Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Over the 3 months period, Ribbon Comms showcased positive performance, achieving a revenue growth rate of 11.02% as of 31 December, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Ribbon Comms’s net margin is impressive, surpassing industry averages. With a net margin of 2.53%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Ribbon Comms’s ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.59%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Ribbon Comms’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 0.56% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.95, Ribbon Comms adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Ribbon Comms visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment