CarMax KMX is preparing to release its quarterly earnings on Thursday, 2025-04-10. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect CarMax to report an earnings per share (EPS) of $0.66.

CarMax bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

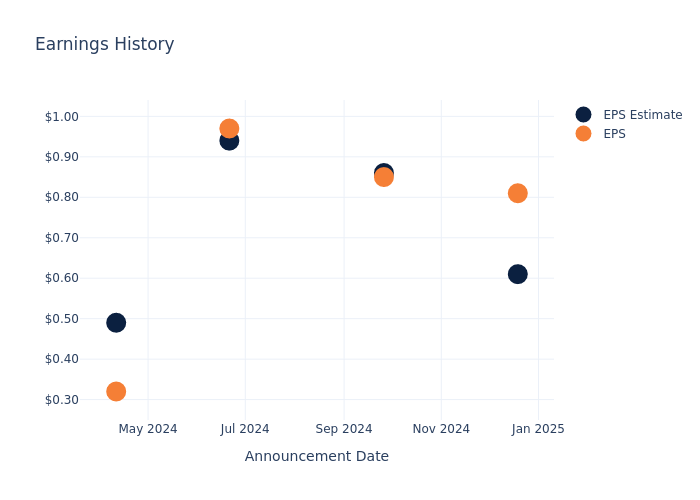

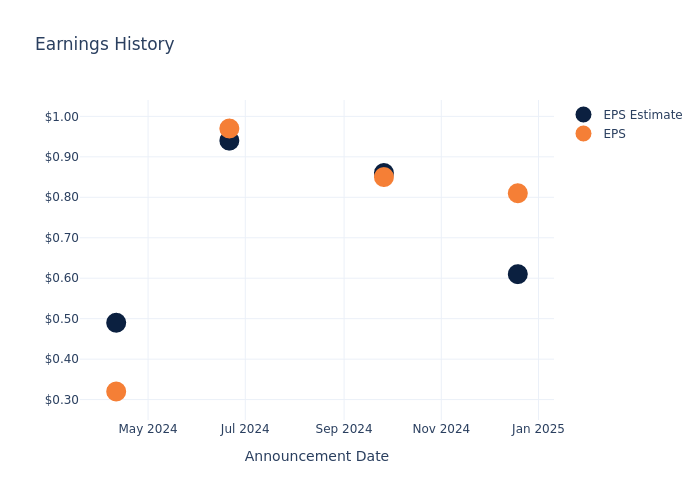

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.20, leading to a 0.05% increase in the share price on the subsequent day.

Here’s a look at CarMax’s past performance and the resulting price change:

| Quarter | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.61 | 0.86 | 0.94 | 0.49 |

| EPS Actual | 0.81 | 0.85 | 0.97 | 0.32 |

| Price Change % | 0.0% | -1.0% | 0.0% | -1.0% |

Market Performance of CarMax’s Stock

Shares of CarMax were trading at $73.31 as of April 08. Over the last 52-week period, shares are up 2.82%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Insights on CarMax

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on CarMax.

The consensus rating for CarMax is Outperform, derived from 4 analyst ratings. An average one-year price target of $92.75 implies a potential 26.52% upside.

Understanding Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Penske Automotive Group, Murphy USA and Lithia Motors, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Underperform trajectory for Penske Automotive Group, with an average 1-year price target of $156.67, suggesting a potential 113.71% upside.

- Analysts currently favor an Neutral trajectory for Murphy USA, with an average 1-year price target of $552.0, suggesting a potential 652.97% upside.

- Analysts currently favor an Outperform trajectory for Lithia Motors, with an average 1-year price target of $394.71, suggesting a potential 438.41% upside.

Comprehensive Peer Analysis Summary

The peer analysis summary presents essential metrics for Penske Automotive Group, Murphy USA and Lithia Motors, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| CarMax | Outperform | 1.22% | $677.65M | 2.02% |

| Penske Automotive Group | Underperform | 6.16% | $1.26B | 4.54% |

| Murphy USA | Neutral | -7.07% | $599M | 17.06% |

| Lithia Motors | Outperform | 19.54% | $1.37B | 3.26% |

Key Takeaway:

CarMax ranks first in revenue growth among its peers. It has the highest gross profit margin. CarMax has the lowest return on equity compared to its peers.

Delving into CarMax’s Background

CarMax sells, finances, and services used and new cars through a chain of around 250 used retail stores. It was formed in 1993 as a unit of Circuit City and spun off into an independent company in late 2002. Used-vehicle sales typically account for about 83% of revenue (79% in fiscal 2024 due to the chip shortage) and wholesale about 13% (19% in fiscal 2024), with the remaining portion composed of extended service plans and repair. In fiscal 2024, the company retailed and wholesaled 765,572, and 546,331 used vehicles, respectively. CarMax is the largest used-vehicle retailer in the US but still estimates that it had only about 3.7% US market share of vehicles 0-10 years old in 2023. It seeks over 5% share a few years from now. CarMax is based in Richmond, Virginia.

CarMax: Delving into Financials

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Positive Revenue Trend: Examining CarMax’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.22% as of 30 November, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: CarMax’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 2.02%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): CarMax’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 2.02% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): CarMax’s ROA stands out, surpassing industry averages. With an impressive ROA of 0.46%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: CarMax’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 3.09.

To track all earnings releases for CarMax visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment