(Bloomberg) — Options traders are betting the S&P 500 Index will post its smallest swing in months following Friday’s US employment report, highlighting how a spate of better-than-expected data has calmed investor worries over the economic impact of President Donald Trump’s tariffs.

Most Read from Bloomberg

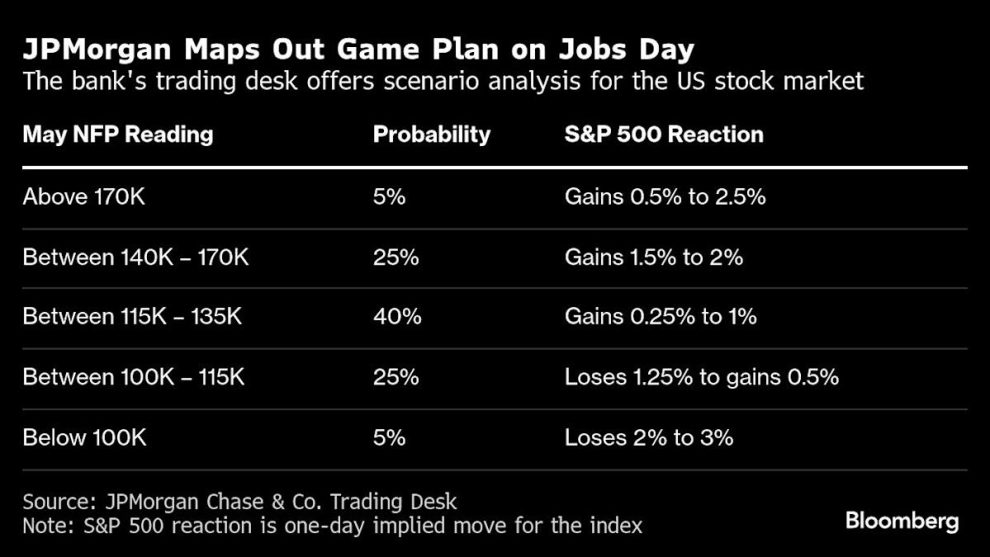

The benchmark is projected to move 0.9% in either direction on Friday, according to data compiled by Piper Sandler & Co. That figure, based on the prices of S&P 500 options straddles as of Tuesday’s close, is the smallest implied swing ahead of a jobs print since February and below an average realized move of 1.3% over the past year.

Concern over the global trade war’s impact on US growth flared in early April, after Trump unveiled a list of tariffs aimed at the country’s trading partners around the globe. Stocks tumbled, with the S&P 500 falling to the edge of a bear market. But Trump has mitigated or stalled many of those levies in the weeks since, while data on measures such as inflation and job openings suggest the economy is taking the trade chaos in stride. The S&P 500 is just 2.8% off its all-time high reached earlier this year, following a weekslong surge.

“Tariffs initially spooked markets, but stocks have recovered because there aren’t meaningful cracks in the economy yet,” said Vishal Vivek, equity trading strategist at Citigroup Inc. “The risk is if unemployment unexpectedly spikes. Then stocks would need to reprice for slower growth.”

Economists polled by Bloomberg expect the US economy to have created roughly 130,000 in May, down from 177,000 a month prior. The jobless rate is expected to hold steady at 4.2%.

ADP Research data on Wednesday showed hiring decelerated to the slowest pace in two years last month, raising concern that Friday’s non-farm payrolls figures could also show labor conditions weakening. A separate report showed activity at US service providers slipped into contraction territory last month for the first time in nearly a year. The S&P 500 Index traded 0.1% higher at 10:04 a.m. in New York.

Sanguine Outlook

Trader positioning reflects a sanguine outlook going into the report. After the S&P 500 soared 6.2% last month — its best May since 1990 — hedge funds and other large speculators have turned net short on futures tied to the Cboe Volatility Index for the first time in five weeks, data from the Commodity Futures Trading Commission show.

Add Comment