Many Americans dream of retiring early — and with the right planning, they can make it a reality. While retiring before the traditional age of 65 isn’t easy, it’s certainly possible with a disciplined approach to your finances.

For You: 3 Proven Strategies To Turn Middle-Class Earnings Into Lasting Family Wealth

Check Out: Mark Cuban Tells Americans To Stock Up on Consumables as Trump’s Tariffs Hit — Here’s What To Buy

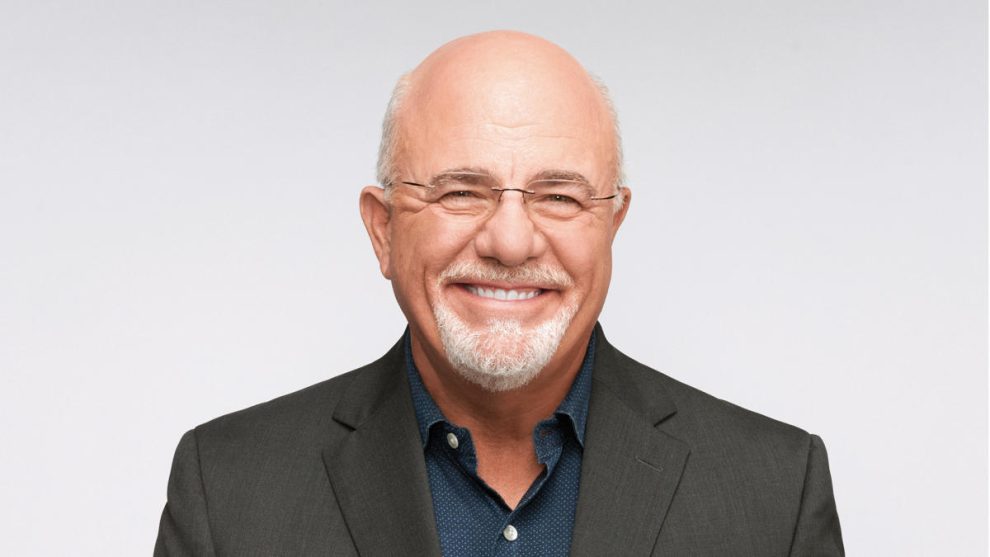

In a recent Ramsey Solutions post, the Ramsey team outlined a checklist of everything you need to do to be able to retire early. See how many items you can check off.

Before you set a budget, you need to determine the type of retirement you want. Are you content with a simple, low-cost lifestyle, or do you envision traveling the world? Answering these questions will help you calculate how much money you’ll need to save.

Once you have a clear picture of how you want your retirement to look, you can create a mock budget. Your budget should include all of your monthly expenses, including savings, utilities, insurance, medical expenses, food, phone, internet, gas and entertainment. Depending on your goals, it may also include categories like charitable giving, a new car fund, a vacation fund, gifts and hobbies. It should also include an “extras” line for unexpected expenses.

The Ramsey Solutions early retirement budget notably leaves out a mortgage payment.

Advertisement: High Yield Savings Offers

Powered by Money.com – Yahoo may earn commission from the links above.

“That’s because you want to pay off the mortgage — and any other debt — before you retire,” the post states. “Debt will destroy your plans to retire early! It will eat up your monthly income and drain your retirement savings faster than you can say ‘foreclosure.’”

Explore More: Suze Orman: 4 Moves Every Aspiring Early Retiree Must Make Today

In addition to saving up a sufficient retirement nest egg, you need to get your current finances in order. This means having a fully funded emergency fund, paying off all debts and actively investing for the future.

If you’re not quite where you need to be, consider taking on a second job or side hustle to speed up your financial progress.

If you plan to retire early, you likely won’t be able to access money in a 401(k) or IRA before age 59½ without paying 10% early withdrawal penalty. That’s why Ramsey Solutions recommends keeping additional investments in a “bridge account.”

“A bridge account will help you bridge the gap … between your early retirement and the time when you can start taking money out of your retirement accounts without a penalty,” the post explains. “That’s where a brokerage account — also known as a taxable investment account — comes in. Brokerage accounts are your best option to serve as your bridge account.”

Ramsey recommends investing in low-turnover mutual funds, such as S&P 500 index funds, inside these accounts.

Real estate can also serve as a “bridge,” providing you with steady income in your early retirement. However, there are rules Ramsey says you need to follow to make this investment work for you.

“First, invest in real estate only after you’ve already paid off your own home,” the Ramsey Solutions post states. “Second, always pay for investment properties in full, with cash — no exceptions! Last (but certainly not least), don’t try to do this alone. When you’re ready to buy a property, make sure you hire a real estate agent who knows what they’re doing.”

Retiring early requires aggressive savings, which usually means cutting back on non-essentials. Categories like clothing, entertainment, travel, dining out, gym memberships and subscription services are all fair game.

Ramsey’s post notes that even making modest cuts to your spending in each of these categories can make a big impact over time.

“Can you imagine how much money you could put away for retirement every month if you cut just $15 from each of these budget categories? That’s $90 a month — $1,080 a year,” the post states. “What if you doubled that amount and cut $30 from each category?”

Before leaving your full-time job, be sure you’ve thought through the practical and emotional realities of early retirement. Ask yourself:

-

Does my budget align with the lifestyle I want in my ideal retirement?

-

Where will I live?

-

Will I continue to work part-time?

-

Can I afford to live without relying on Social Security benefits early?

-

Do I have a plan for paying for healthcare and other health-related expenses?

-

How will I withdraw from my various income streams?

Ramsey Solutions recommends meeting regularly with a trusted financial advisor throughout both your planning phase and your retirement to ensure you’re staying on track.

“You need to keep an eye on your money,” the post states. “You need to ask questions about concepts and terminology that don’t make sense. Stay involved in your financial portfolio — but don’t make decisions before you’ve talked them through with a professional who knows their stuff and has the patience to explain it.”

If you can check off most or all items from the Ramsey Solutions checklist, you’re likely in a good place to retire early. But there are additional steps you may want to consider to ensure your financial security in retirement. First, consider adding life insurance to your retirement plan.

“Life insurance can help protect you and your beneficiaries from taxes and other debts your estate may owe after your death,” said Rafael Rubio, president of Stable Retirement Planners in Southfield, Michigan. “That’s because life insurance pays a death benefit to your beneficiaries tax-free.”

It’s also important to create an estate plan.

“A critical aspect of being able to retire comfortably is an estate plan that includes a last will and testament or a revocable living trust,” said Chris Cohan, estate and financial advisor at RJP Estate Planning. “These documents help ensure that your assets are distributed according to your wishes.

“For those with young children, naming a guardian is essential,” he continued. “Naming a power of attorney and having medical directives to help dictate who can make financial and medical decisions on your behalf in the event of incapacity is essential as well.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey’s Financial Health Checklist: Are You Able To Retire Early?

Add Comment