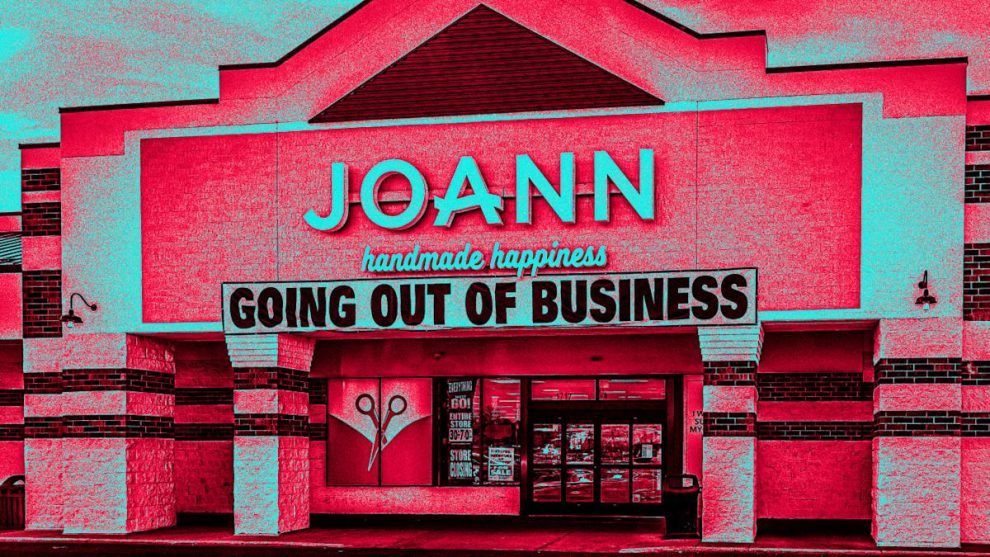

Joann, the beloved fabrics, arts, and crafts retailer, is finally shutting its doors for good after a long, slow goodbye.

Most Read from Fast Company

While many of its 800 stores have already been shuttered since the company filed for bankruptcy (yet again) in January, the last 444 Joann stores (yes, you read that right) will finally shut their doors on Friday, May 30, according to Joann’s website.

As Fast Company previously reported, the popular fabrics and crafts supplier announced earlier this year that it would close all its U.S. locations after it filed for bankruptcy in January 2025, marking the second time Joann declared bankruptcy in less than a year. It also laid off all 19,000 workers, including more than 15,000 part-time store associates.

Like many brick-and-mortar retailers that have filed for bankruptcy, including Party City and Forever 21, Joann faced declining sales and foot traffic since the COVID-19 pandemic, as more Americans shop online and curb spending due to higher prices, the soaring cost of living, inflation, and President Donald Trump’s on-again, off-again tariff wars.

From TikTok and Reddit to Instagram and Facebook, customers have been taking to social media, posting tearfully and nostalgically about time they spent in the store. Some even shared “last haul” videos of what they bought in the store’s final days.

On Reddit, nostalgic customers and workers posted multiple threads saying “goodbye” to individual stores. Some featured photos of the shuttered front door, like this one—which read: “RIP Joann 1943-2025. Died due to private equity and corporate greed”—lamenting the end of 80 years in business. (More on the private equity aspect below.)

Meanwhile, on TikTok, one woman with tears in her eyes posted: “Y’all I really can’t believe but I just really had a moment, Joann is f—-ing closing. It’s so unfortunate.”

By the 1990s, Joann (once known as Jo-Ann Fabrics) became the largest fabric and crafts retail superstore in the U.S., and was taken private in 2011 by Leonard Green & Partners, a private equity firm, for around $1.6 billion. Then, a decade later, it went public again as the COVID-19 pandemic fueled an uptick in crafting, Fast Company previously reported.

Add Comment