Although we may never see trade tariffs with the United States fall to prior levels, at least during President Trump’s second term, the soothing of tensions between the US and Asia could be the catalyst for a resumption of the region’s burgeoning artificial intelligence industry.

Asia-Pacific markets rallied on the news that China and the US had agreed to a trade deal that included a 90-day pause on tariffs and a 115% drop on prior reciprocal tariffs.

The news saw Hong Kong’s Hang Seng Index climb 2.3%, while Korea Republic’s KOSPI Index also posted healthy 1.23% gains. However, analysts have been quick to warn anyone believing that it’ll be smooth sailing throughout the region off the back of the positive news.

Julius Baer strategists have suggested that a rollback of tariffs to pre-conflict levels is ‘unlikely’, stating that any new deals announced are likely to involve ‘complex conditions and protracted implementation timelines,’ which could dampen APAC’s economic recovery from the shock of tariffs.

Despite this, the news of a tariffs de-escalation will undoubtedly be welcomed throughout the region, particularly after Morgan Stanley suggested that trade risk could see Asian tech stocks fall 20%.

Prior to the announcement of President Trump’s so-called reciprocal tariffs, Chinese tech stocks listed in Hong Kong had posted their best weekly winning streak since 2020 following an impressive earnings season throughout the nation’s artificial intelligence sector that drew international investor interest.

Given the disruption of the trade levies, which climbed as high as 145% during the peak of the conflict between the United States and China, there’s renewed hope that the region can return to its prosperous outlook built on AI innovation.

Bullish Sentiment Returns to APAC

The trade war with the United States threatened to hamper a wave of strong market sentiment sweeping through the Asia-Pacific region following DeepSeek’s artificial intelligence breakthrough in China.

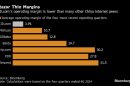

Buoyed by the success of DeepSeek and the rollout of government stimulus intended to drive innovation, China’s tech sector appears to be booming.

By March, the MSCI China Index had climbed almost 18% before tariff uncertainty caused a significant retracing of its growth. Likewise, February saw a total net capital inflow of $3.8 billion into Chinese stocks, according to Morgan Stanley data.

It’s these positive market movements that have enabled firms like Tianju Dihe (Suzhou) Data Co. Ltd. (2479.HK) to post increasingly optimistic profit growth forecasts amid China’s growing tech sector.

In a recent filing, Tianju Dihe announced that it expects to post a net profit of 50 million yuan ($6.9 million) to 53 million yuan for last year, up 43% to 51% from 2023 after the company went public in Hong Kong last year.

The company, which attributes much of its revenue increase to its core application programming interface (API), is an example of how APAC’s prosperous AI landscape can be the tide that raises all boats throughout the region’s tech sector.

China’s AI Boom

There’s no getting away from China’s impact on the Asia-Pacific region’s artificial intelligence boom. The nation’s government recently announced plans to invest 10 trillion yuan ($1.4 trillion) over the next 15 years in a bid to gain an edge in advanced technology.

January saw the launch of a 60 billion yuan investment fund domestically, in a move that could help to counter the threat of US hostility towards Chinese AI initiatives.

The fund was launched just days after the United States tightened export controls for its advanced chips, placing more Chinese firms on a trade blacklist as part of its ongoing security concerns.

These initiatives come as China appears determined to secure 5% growth in 2025, even as the US continues to bring tariff uncertainty to international trade.

Asia-Pacific countries have also been strengthening their positions amidst the AI boom and now account for a significant volume of the world’s semiconductor fabrication.

Regional leaders like China, Taiwan, Japan, and the Republic of Korea are forecasted to account for 75% of the world’s semiconductor manufacturing in 2025. It’s this industrial strength that’s helping the region to become an attractive place for global businesses to grow their operations.

It’s also paving the way for more non-domestic businesses to explore their options for Chinese market entry and growth as a strategy to tap into the region’s flourishing tech landscape.

We’re even seeing US market leaders like Nvidia navigating trade uncertainty on both sides of the Pacific by adapting its H20 AI chip to become compliant with US export regulations after its initial product was banned.

It’s this commitment to embracing the Asia-Pacific region that’s driving optimism for its future AI capabilities.

Uncertainty Still Lingers

While the future looks bright for Asia-Pacific AI initiatives, it’s worth noting that the outcome of the United States’ trade tariffs following their 90-day postponement will be decisive for the region’s market growth over the foreseeable future.

Although we’re seeing signs of tech resilience that indicate APAC’s brightest tech stocks will remain resilient in the face of tariffs, a full de-escalation could be the catalyst for real growth. Clearing skies for trade prospects could help to drive growth throughout China and beyond and can solidify the region’s status as a key player in the artificial intelligence boom period.

Disclosure: On the date of publication, Dmytro Spilka did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer. Dmytro Spilka does not intend to make a trade in any of the securities mentioned above in the next 72 hours.

Add Comment