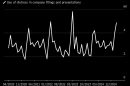

The Vanguard S&P 500 ETF (VOO) pulled in $2.2 billion Wednesday, growing to $607.5 billion, according to etf.com daily fund flows data. The inflows came as markets whipsawed through a volatile session after data showed the U.S. economy contracted 0.3% in the first quarter, though the S&P 500 ultimately closed up 0.2%.

The SPDR S&P 500 ETF Trust (SPY) attracted $471.2 million despite the economic concerns, while the SPDR Bloomberg High Yield Bond ETF (JNK) gained $379.2 million, expanding its assets by 6%. The Financial Select Sector SPDR Fund (XLF) collected $326.1 million.

The iShares Core S&P 500 ETF (IVV) experienced the largest outflows at $556.9 million during the rocky trading session. The iShares Short Treasury Bond ETF (SHV) saw $537.8 million exit, while the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) lost $518.2 million.

U.S. equity ETFs gained $2.3 billion despite the negative GDP report. Fixed-income ETFs added $381.7 million while commodity ETFs lost $117.5 million. Overall, ETFs experienced net inflows of $4.4 billion as the market closed out a turbulent April that saw the S&P 500 finish with a 0.8% monthly loss.

|

Ticker |

Name |

Net Flows ($, mm) |

AUM ($, mm) |

AUM % Change |

|

2,190.75 |

607,503.52 |

0.36% |

||

|

471.16 |

572,036.87 |

0.08% |

||

|

379.19 |

6,320.63 |

6.00% |

||

|

326.09 |

49,679.86 |

0.66% |

||

|

270.97 |

38,727.97 |

0.70% |

||

|

260.31 |

27,024.40 |

0.96% |

||

|

252.40 |

13,112.31 |

1.92% |

||

|

251.59 |

14,230.35 |

1.77% |

||

|

227.70 |

27,714.25 |

0.82% |

||

|

224.48 |

24,196.51 |

0.93% |

|

Ticker |

Name |

Net Flows ($, mm) |

AUM ($, mm) |

AUM % Change |

|

-556.92 |

560,513.72 |

-0.10% |

||

|

-537.84 |

22,697.60 |

-2.37% |

||

|

-518.18 |

47,695.30 |

-1.09% |

||

|

-470.80 |

58,064.78 |

-0.81% |

||

|

-309.06 |

298,720.94 |

-0.10% |

||

|

-304.70 |

100,306.91 |

-0.30% |

||

|

-284.93 |

1,698.16 |

-16.78% |

||

|

-240.76 |

8,102.77 |

-2.97% |

||

|

-236.96 |

23,059.00 |

-1.03% |

||

|

-228.03 |

69,743.39 |

-0.33% |

|

|

Net Flows ($, mm) |

AUM ($, mm) |

% of AUM |

|

Alternatives |

-0.77 |

9,789.65 |

-0.01% |

|

Asset Allocation |

42.83 |

23,761.77 |

0.18% |

|

Commodities ETFs |

-117.51 |

212,703.92 |

-0.06% |

|

Currency |

184.89 |

122,667.06 |

0.15% |

|

International Equity |

711.28 |

1,676,942.81 |

0.04% |

|

International Fixed Income |

702.68 |

280,727.51 |

0.25% |

|

Inverse |

172.08 |

15,061.38 |

1.14% |

|

Leveraged |

6.48 |

107,403.93 |

0.01% |

|

US Equity |

2,348.99 |

6,379,087.27 |

0.04% |

|

US Fixed Income |

381.73 |

1,650,107.23 |

0.02% |

|

Total: |

4,432.68 |

10,478,252.54 |

0.04% |

Disclaimer: All data as of 6 a.m. Eastern time the date the article is published. Data are believed to be accurate; however, transient market data are often subject to subsequent revision and correction by the exchanges.

Add Comment