Investors with a lot of money to spend have taken a bullish stance on Exxon Mobil XOM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with XOM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 17 uncommon options trades for Exxon Mobil.

This isn’t normal.

The overall sentiment of these big-money traders is split between 64% bullish and 29%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $417,659, and 10 are calls, for a total amount of $641,708.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $130.0 for Exxon Mobil over the recent three months.

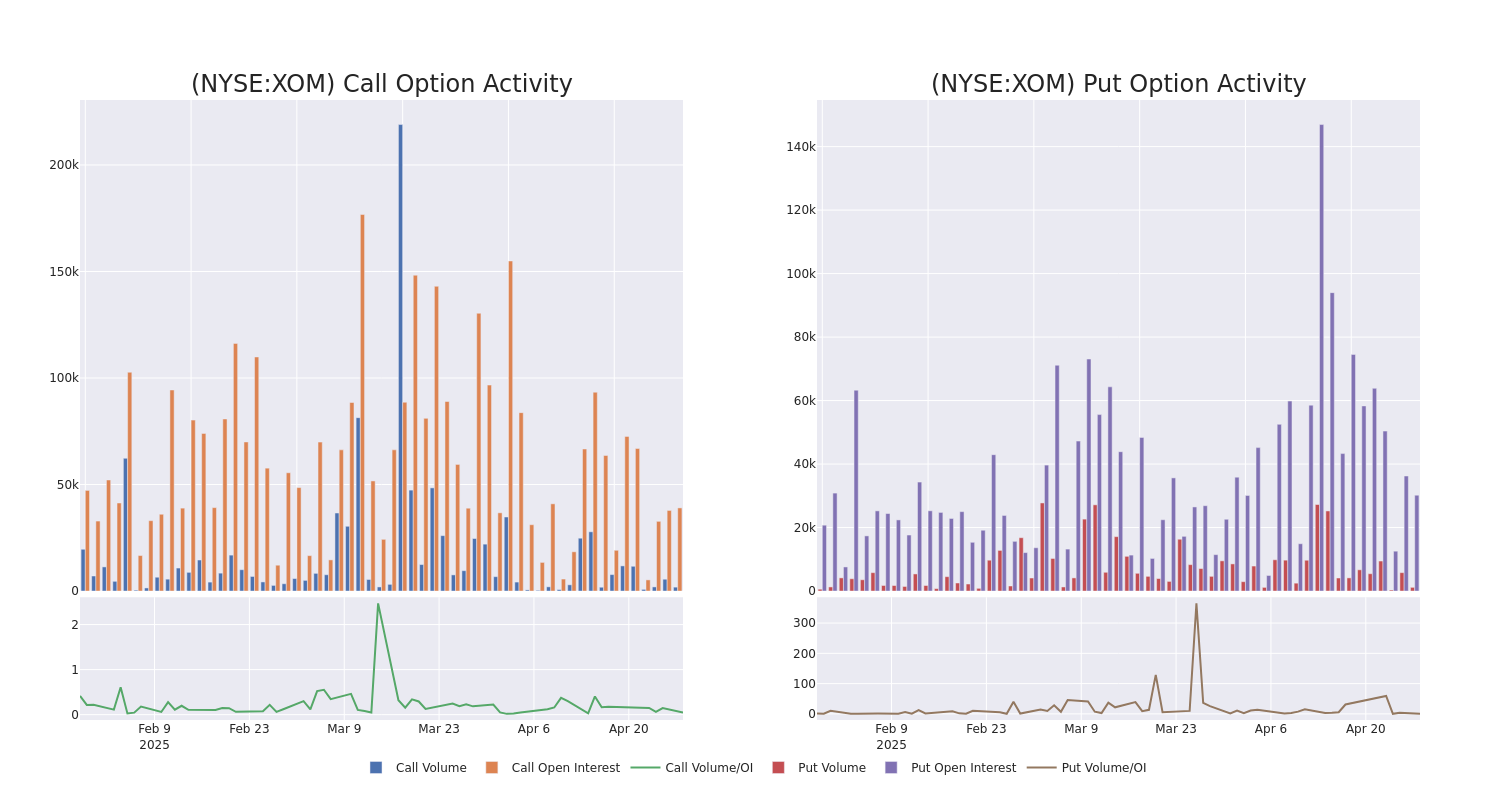

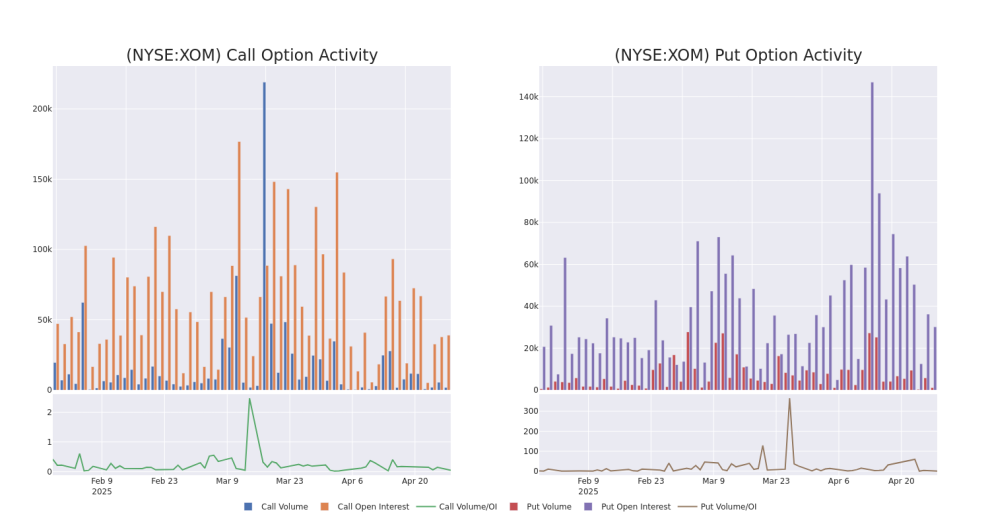

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Exxon Mobil’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Exxon Mobil’s substantial trades, within a strike price spectrum from $75.0 to $130.0 over the preceding 30 days.

Exxon Mobil 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | CALL | TRADE | BEARISH | 05/30/25 | $1.83 | $1.73 | $1.73 | $112.00 | $206.3K | 173 | 0 |

| XOM | CALL | SWEEP | BULLISH | 01/16/26 | $4.85 | $4.75 | $4.85 | $120.00 | $142.1K | 12.3K | 371 |

| XOM | PUT | SWEEP | BULLISH | 01/16/26 | $4.7 | $4.6 | $4.6 | $95.00 | $115.0K | 5.7K | 258 |

| XOM | PUT | TRADE | BULLISH | 09/19/25 | $7.9 | $7.85 | $7.85 | $110.00 | $73.0K | 4.1K | 94 |

| XOM | PUT | SWEEP | BULLISH | 06/20/25 | $3.4 | $3.3 | $3.4 | $105.00 | $63.9K | 13.2K | 408 |

About Exxon Mobil

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil worldwide. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one of the world’s largest refiners, with a total global refining capacity of 4.5 million barrels of oil per day, and is one of the world’s largest manufacturers of commodity and specialty chemicals.

After a thorough review of the options trading surrounding Exxon Mobil, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Exxon Mobil

- Trading volume stands at 6,270,221, with XOM’s price up by 0.05%, positioned at $108.62.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 4 days.

What The Experts Say On Exxon Mobil

In the last month, 5 experts released ratings on this stock with an average target price of $128.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Mizuho persists with their Neutral rating on Exxon Mobil, maintaining a target price of $129.

* An analyst from UBS persists with their Buy rating on Exxon Mobil, maintaining a target price of $131.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Exxon Mobil, targeting a price of $135.

* An analyst from Scotiabank persists with their Sector Outperform rating on Exxon Mobil, maintaining a target price of $115.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Exxon Mobil with a target price of $130.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Exxon Mobil options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment