Laboratory Corp LH is set to give its latest quarterly earnings report on Tuesday, 2025-04-29. Here’s what investors need to know before the announcement.

Analysts estimate that Laboratory Corp will report an earnings per share (EPS) of $3.73.

Anticipation surrounds Laboratory Corp’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

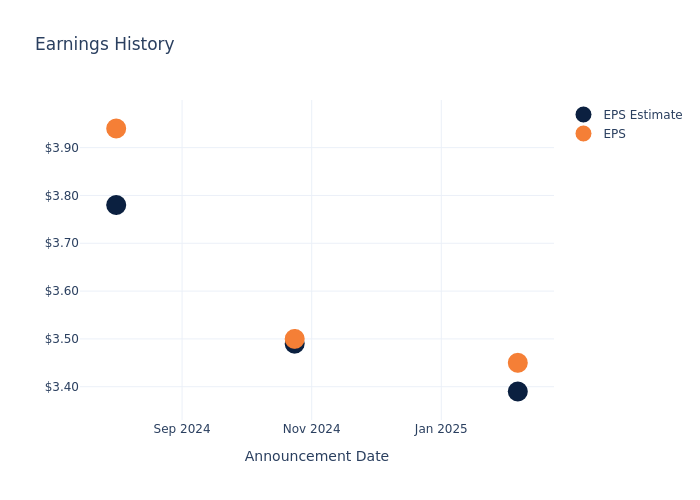

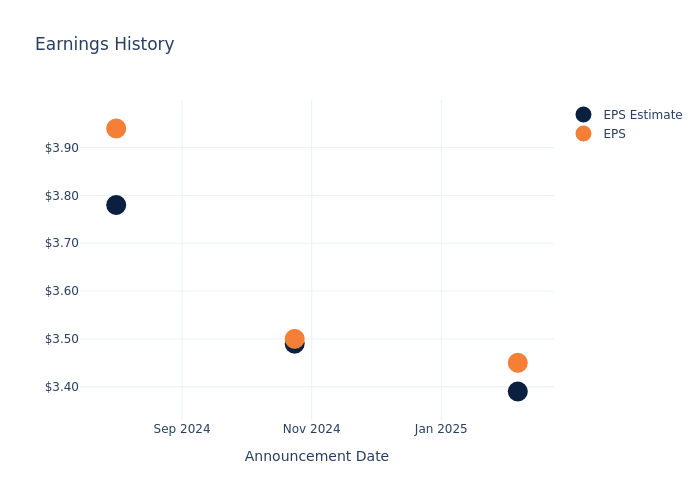

Overview of Past Earnings

In the previous earnings release, the company beat EPS by $0.06, leading to a 0.59% drop in the share price the following trading session.

Here’s a look at Laboratory Corp’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 3.39 | 3.49 | 3.78 | 3.48 |

| EPS Actual | 3.45 | 3.50 | 3.94 | 3.68 |

| Price Change % | -1.0% | -1.0% | 1.0% | 0.0% |

Performance of Laboratory Corp Shares

Shares of Laboratory Corp were trading at $228.31 as of April 25. Over the last 52-week period, shares are up 13.57%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Laboratory Corp

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Laboratory Corp.

The consensus rating for Laboratory Corp is Buy, derived from 9 analyst ratings. An average one-year price target of $273.0 implies a potential 19.57% upside.

Peer Ratings Comparison

The analysis below examines the analyst ratings and average 1-year price targets of Quest Diagnostics, DaVita and Chemed, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Quest Diagnostics, with an average 1-year price target of $183.86, suggesting a potential 19.47% downside.

- Analysts currently favor an Neutral trajectory for DaVita, with an average 1-year price target of $169.0, suggesting a potential 25.98% downside.

- Analysts currently favor an Outperform trajectory for Chemed, with an average 1-year price target of $670.5, suggesting a potential 193.68% upside.

Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Quest Diagnostics, DaVita and Chemed, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Labcorp Hldgs | Buy | 9.76% | $896.30M | 1.77% |

| Quest Diagnostics | Neutral | 12.09% | $863M | 3.20% |

| DaVita | Neutral | 4.73% | $1.07B | 102.13% |

| Chemed | Outperform | 1.09% | $234.12M | 6.24% |

Key Takeaway:

Laboratory Corp ranks highest in gross profit among its peers. It is in the middle for consensus rating and revenue growth. However, it has the lowest return on equity compared to the other companies analyzed.

Get to Know Laboratory Corp Better

Labcorp is one of the nation’s two largest independent clinical laboratories, with roughly 20% of the independent lab market. The company operates approximately 2,000 patient-service centers, offering a broad range of 5,000 clinical lab tests, ranging from routine blood and urine screens to complex oncology and genomic testing.

Laboratory Corp’s Financial Performance

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Over the 3 months period, Laboratory Corp showcased positive performance, achieving a revenue growth rate of 9.76% as of 31 December, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Laboratory Corp’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 4.31% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Laboratory Corp’s ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 1.77%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Laboratory Corp’s ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.78%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Laboratory Corp’s debt-to-equity ratio is below the industry average. With a ratio of 0.9, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Laboratory Corp visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment