We’ve been getting ambiguous signals in the economic data.

On one hand, the soft, sentiment-oriented data has been disappointing. The University of Michigan and the Conference Board’s surveys of consumer confidence have turned sharply lower in recent months. The NFIB’s Small Business Optimism index has tanked. Sentiment among CEOs and CFOs has turned south. Purchasing managers at manufacturing and services firms have also become increasingly cautious. And it’s all because of the Trump administration’s volatile position on tariffs — which most people agree are net negative for the economy.

On the other hand, the hard data, which reflects actual activity, has been strong. Retail sales hit a record high in March, and weekly card spending data suggest that strength has continued into April. Durable goods orders and shipments continue at elevated levels. Meanwhile, key labor market metrics including job creation, unemployment, and claims for unemployment insurance continue to trend at levels associated with economic expansion.

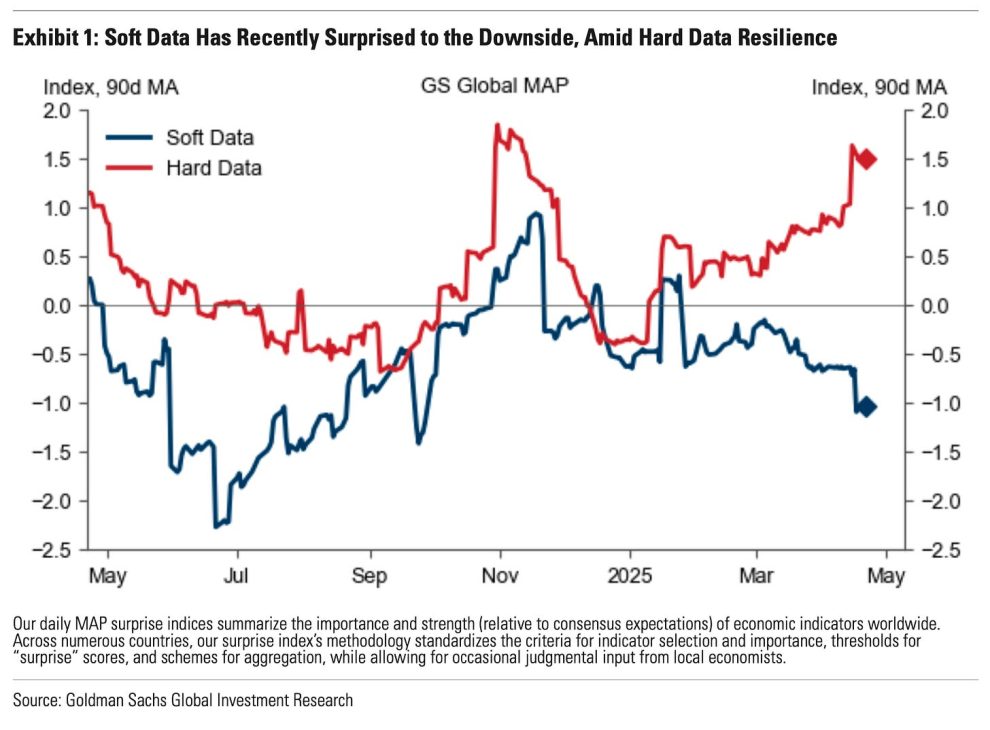

This narrative of contradictions is illustrated nicely in this chart from Goldman Sachs, which shows how soft data has been surprising to the downside while hard data has been surprising to the upside. In other words, sentiment has been weaker than expected while realized activity has been stronger than expected.

Renaissance Macro’s Neil Dutta wrote about these “data discontinuities” in his April 21 note.

“It’s probable that much of the recent upside surprises in hard data reflect pulling forward activity in the anticipation of tariffs,” Dutta wrote. “Consumers pulled forward auto sales and consumption on other household durables, as an example. Firms likely pulled forward some orders too. That likely gives the veneer of strength in the recent high-frequency dataflow.”

During much of the economic expansion that began in 2020, it’s paid off to focus on what consumers and businesses did (i.e., the hard data) over what they said (i.e., the soft data). The Federal Reserve just published research explaining this phenomenon.

But in a world where many are aware of the inflationary risks of new tariffs, this pull-forward of sales comes with two issues: 1) it masks what may be a much weaker underlying economy, and 2) we could get depressed sales in the future when these pulled-forward sales would’ve normally occurred.

“[R]ecent hard data in the U.S., mostly for March, are overstating activity and it’s worth noting that conditions were not especially strong to begin with,” Dutta added. “The collapse across a range of survey-based measures of activity suggest that actual activity will continue to slowdown, in a potentially abrupt manner. Recession may already be here.”

The big picture 🖼️

We’ll only know with the benefit of hindsight whether or not we’re in a recession or going into a recession.

However, we know that the economy had been cooling and that the threat of tariffs increased the risk of recession.

Importantly, as long term investors, we should understand that recessions and market downturns will happen as you build wealth with stocks.

The economy has been in expansion about 80% of the time. Similarly, stocks have been in a bull market about 80% of the time. Maybe we’re currently going through an unpleasant period that has historically occurred about 20% of the time.

**

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment