PASADENA, Calif., April 28, 2025 /PRNewswire/ — Alexandria Real Estate Equities, Inc. ARE announced financial and operating results for the first quarter ended March 31, 2025.

|

Key highlights |

|||||

|

Operating results |

1Q25 |

1Q24 |

|||

|

Total revenues: |

|||||

|

In millions |

$ 758.2 |

$ 769.1 |

|||

|

Net (loss) income attributable to Alexandria’s common stockholders – diluted: |

|||||

|

In millions |

$ (11.6) |

$ 166.9 |

|||

|

Per share |

$ (0.07) |

$ 0.97 |

|||

|

Funds from operations attributable to Alexandria’s common stockholders – diluted, as adjusted: |

|||||

|

In millions |

$ 392.0 |

$ 403.9 |

|||

|

Per share |

$ 2.30 |

$ 2.35 |

|||

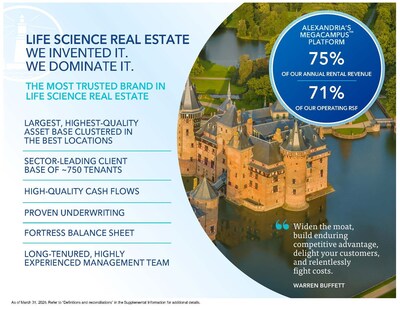

A sector-leading REIT with a high-quality, diverse tenant base and strong margins

|

(As of March 31, 2025, unless stated otherwise) |

||||

|

Occupancy of operating properties in North America |

91.7 % |

(1) |

||

|

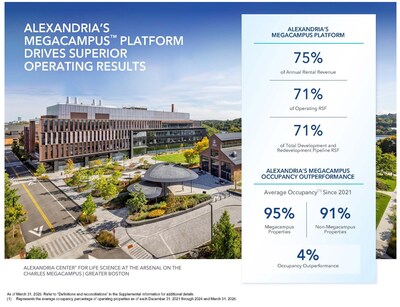

Percentage of annual rental revenue in effect from Megacampus™ platform |

75 % |

|||

|

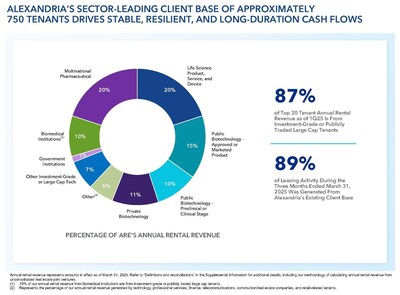

Percentage of annual rental revenue in effect from investment-grade or publicly traded large cap tenants |

51 % |

|||

|

Operating margin |

70 % |

|||

|

Adjusted EBITDA margin |

71 % |

|||

|

Percentage of leases containing annual rent escalations |

98 % |

|||

|

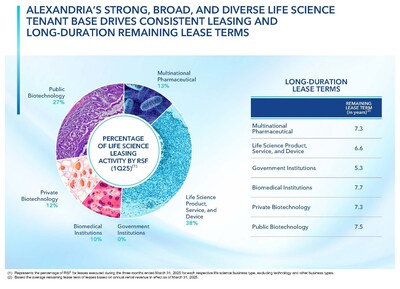

Weighted-average remaining lease term: |

||||

|

Top 20 tenants |

9.6 |

years |

||

|

All tenants |

7.6 |

years |

||

|

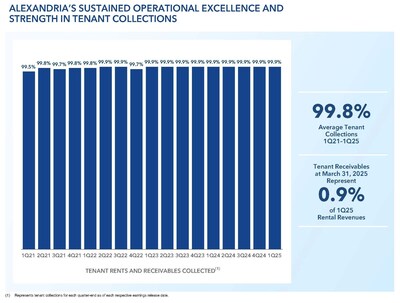

Sustained strength in tenant collections: |

||||

|

April 2025 tenant rents and receivables collected as of April 28, 2025 |

99.8 % |

|||

|

1Q25 tenant rents and receivables collected as of April 28, 2025 |

99.9 % |

|

(1) Refer to “Summary of properties and occupancy” in the Supplemental Information for additional details. |

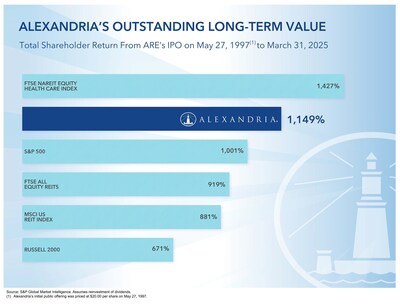

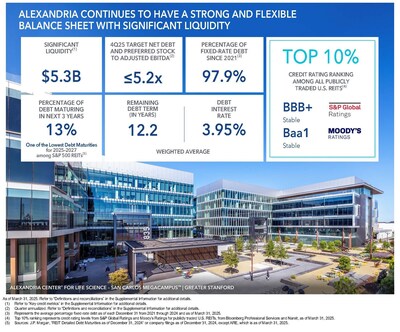

Strong and flexible balance sheet with significant liquidity; top 10% credit rating ranking among all publicly traded U.S. REITs

- Net debt and preferred stock to Adjusted EBITDA of 5.9x and fixed-charge coverage ratio of 4.3x for 1Q25 annualized, with 4Q25 annualized targets of ≤5.2x and 4.0x to 4.5x, respectively.

- Significant liquidity of $5.3 billion.

- Only 13% of our total debt matures through 2027.

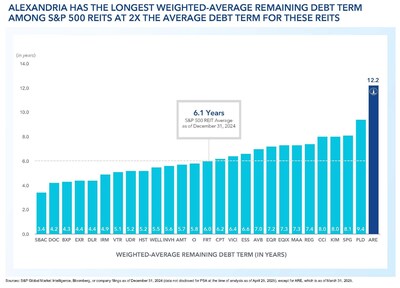

- 12.2 years weighted-average remaining term of debt, longest among S&P 500 REITs.

- Since 2021, an average of 97.9% of our year-end debt balances have been fixed rate.

- Total debt and preferred stock to gross assets of 30%.

- $414.9 million of capital contribution commitments from existing real estate joint venture partners to fund construction from 2Q25 through 2027 and beyond, including $166.8 million from 2Q25 to 4Q25.

Continued solid leasing volume and rental rate increases

- Continued solid leasing volume of 1.0 million RSF during 1Q25, the fifth consecutive quarter with leasing volume exceeding 1 million RSF.

- Solid rental rate increases on lease renewals and re-leasing of space of 18.5% and 7.5% (cash basis) for 1Q25.

- 89% of our leasing activity during the three months ended March 31, 2025 was generated from our existing tenant base.

|

1Q25 |

||||||

|

Total leasing activity – RSF |

1,030,553 |

|||||

|

Lease renewals and re-leasing of space: |

||||||

|

RSF (included in total leasing activity above) |

884,408 |

|||||

|

Rental rate increase |

18.5 % |

|||||

|

Rental rate increase (cash basis) |

7.5 % |

|||||

|

Leasing of development and redevelopment space – RSF |

6,430 |

(1) |

|

(1) As of March 31, 2025, our construction projects expected to stabilize in 2025 and 2026 were 75% leased/negotiating. |

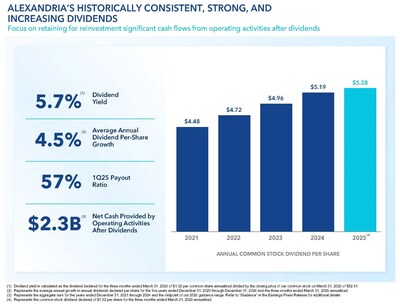

Dividend strategy to share net cash flows from operating activities with stockholders while retaining a significant portion for reinvestment

- Common stock dividend declared for 1Q25 of $1.32 per share aggregating $5.24 per common share for the twelve months ended March 31, 2025, up 22 cents, or 4%, over the twelve months ended March 31, 2024.

- Dividend yield of 5.7% as of March 31, 2025.

- Dividend payout ratio of 57% for the three months ended March 31, 2025.

- Average annual dividend per-share growth of 4.5% from 2021 through 1Q25 annualized.

- Significant net cash flows provided by operating activities after dividends retained for reinvestment aggregating $2.3 billion for the years ended December 31, 2021 through 2024 and the midpoint of our 2025 guidance range.

Ongoing execution of Alexandria’s 2025 capital recycling strategy

We plan to continue funding a significant portion of our capital requirements for the year ending December 31, 2025 through dispositions of non-core assets, land, partial interest sales, and sales to owner/users.

|

(in millions) |

|||||

|

Completed dispositions |

$ 176 |

||||

|

Our share of pending transactions subject to non-refundable deposits, signed letters of intent, and/or purchase and sale agreement negotiations |

433 |

||||

|

Our share of completed and pending 2025 dispositions |

609 |

31 % |

|||

|

Additional targeted dispositions |

1,341 |

69 |

|||

|

2025 guidance midpoint for dispositions and sales of partial interests |

$ 1,950 |

100 % |

|||

Alexandria’s development and redevelopment pipeline delivered incremental annual net operating income of $37 million commencing during 1Q25, with an additional $171 million of incremental annual net operating income anticipated to deliver by 4Q26

- During 1Q25, we placed into service development and redevelopment projects aggregating 309,494 RSF that are 100% leased across multiple submarkets and delivered incremental annual net operating income of $37 million. A significant 1Q25 delivery was 285,346 RSF at 230 Harriet Tubman Way located at the Alexandria Center® for Life Science – Millbrae in our South San Francisco submarket.

- Our active development and redevelopment projects under construction, primarily related to our Megacampus ecosystems, have an estimated $2.4 billion of remaining costs to complete, of which $1.3 billion is not under contract as of March 31, 2025. Additionally, we estimate that 30%–40% of the costs not under contract represent costs for materials that may be subject to inflationary pressure and/or potential tariffs. As such, we estimate that each 10% increase in these costs for materials may result in incremental costs aggregating $40–$50 million and a corresponding decline in initial stabilized yields of approximately 2.5 to 3.5 basis points for our existing active development and redevelopment projects. This estimate does not account for the cost of potential delays that may occur in receiving or replacing materials subject to tariffs.

- Annual net operating income (cash basis) from recently delivered projects is expected to increase by $61 million by 4Q25 upon the burn-off of initial free rent, which have a weighted-average burn-off period of approximately four months.

- 71% of the RSF in our total development and redevelopment pipeline is within our Megacampus ecosystems.

|

Development and Redevelopment Projects |

Incremental Annual Net Operating Income |

RSF |

Leased/ Negotiating Percentage |

||||||||

|

(dollars in millions) |

|||||||||||

|

Placed into service in 1Q25 |

$ 37 |

309,494 |

100 % |

||||||||

|

Expected to be placed into service: |

|||||||||||

|

2Q25 through 4Q26 |

$ 171 |

(1) |

1,597,920 |

(2) |

75 % |

(3) |

|||||

|

2027 through 2Q28 |

$ 179 |

2,449,862 |

16 % |

||||||||

|

(1) |

Includes expected partial deliveries through 4Q26 from projects expected to stabilize in 2027 and beyond. Refer to the initial and stabilized occupancy years under “New Class A/A+ development and redevelopment properties: current projects” in the Supplemental Information for additional details. |

|||||

|

(2) |

Represents the RSF related to projects expected to stabilize by 4Q26. Does not include partial deliveries through 4Q26 from projects expected to stabilize in 2027 and beyond. |

|||||

|

(3) |

Represents the leased/negotiating percentage of development and redevelopment projects that are expected to stabilize during 2025 and 2026. |

Significant leasing progress on 1Q25 temporary vacancy, including previously disclosed 1Q25 key lease expirations

|

Occupancy as of December 31, 2024 |

94.6 % |

|||||||

|

Lease expirations which became vacant as of March 31, 2025: |

||||||||

|

Re-leased with future delivery or subject to ongoing negotiations |

(1.3) |

(1) |

||||||

|

Marketing |

(1.6) |

(2.9) |

(2) |

|||||

|

Occupancy as of March 31, 2025 |

91.7 % |

|

(1) |

Includes 0.7% of RSF that is re-leased with a weighted-average commencement date around the end of 2025 and 0.6% of RSF that is subject to ongoing negotiations. |

|||||

|

(2) |

Includes 768,080 RSF of previously disclosed 1Q25 key lease expirations. Refer to “Summary of properties and occupancy” in the Supplemental Information for additional details. The balance of the 1Q25 lease expirations that became vacant was spread across multiple submarkets, with no individual space aggregating greater than 62,000 RSF. |

Maintained solid operating metrics

- Net operating income (cash basis) of $2.0 billion for 1Q25 annualized, up $83.8 million, or 4.4%, compared to 1Q24 annualized.

- Same property net operating income changes of (3.1)% and 5.1% (cash basis) for 1Q25 over 1Q24 includes certain 1Q25 lease expirations aggregating 768,080 RSF at six properties across four submarkets. Excluding the impact of these lease expirations, same property net operating income changes for 1Q25 would have been 0.1% and 9.0% (cash basis).

- General and administrative expenses of $30.7 million, savings of $16.4 million or 35%, for 1Q25, compared to 1Q24 is primarily the result of cost-control and efficiency initiatives on personnel-related costs and streamlining of business processes.

- As a percentage of net operating income, our general and administrative expenses for the trailing twelve months ended March 31, 2025 were 6.9%, representing the lowest level in the past ten years, compared to 9.5% for the trailing twelve months ended March 31, 2024.

Strong and flexible balance sheet

Key metrics as of or for the three months ended March 31, 2025

- $28.8 billion in total market capitalization.

- $15.7 billion in total equity capitalization.

|

1Q25 |

Target |

|||||||||

|

Quarter Annualized |

Trailing 12 Months |

4Q25 Annualized |

||||||||

|

Net debt and preferred stock to Adjusted EBITDA |

5.9x |

5.7x |

Less than or equal to 5.2x |

|||||||

|

Fixed-charge coverage ratio |

4.3x |

4.4x |

4.0x to 4.5x |

|||||||

Key capital events

- In February 2025, we issued $550.0 million of unsecured senior notes payable, due in 2035, with an interest rate of 5.50%. This issuance marked our tightest-ever spread to the 10-year treasury rate, surpassing our previous record in September 2019 by 25 bps.

- Upon maturity on April 30, 2025, we expect to repay $600.0 million of our 3.45% unsecured senior notes payable.

- In 1Q25, our unconsolidated real estate joint venture at 1655 and 1725 Third Street, in which we own a 10% interest, located in our Mission Bay submarket, refinanced $500 million of an existing fixed-rate secured note payable with a new secured note payable, which bears a fixed weighted-average interest rate of 6.37% and matures in 2035.

- Under our common stock repurchase program authorized in December 2024, we may repurchase up to $500.0 million of our common stock through December 31, 2025.

- During 1Q25, we repurchased 2.2 million shares of common stock for an aggregate value of $208.1 million at an average price per share of $96.71.

- As of April 28, 2025, the approximate value of shares authorized and remaining under this program was $241.8 million.

Investments

- As of March 31, 2025:

- Our non-real estate investments aggregated $1.5 billion.

- Unrealized gains presented in our consolidated balance sheet were $31.9 million, comprising gross unrealized gains and losses aggregating $204.9 million and $173.1 million, respectively.

- Investment loss of $50.0 million for 1Q25 presented in our consolidated statement of operations consisted of $29.3 million of realized gains, $68.1 million of unrealized losses, and $11.2 million of impairment charges.

Other key highlights

|

Key items included in net income attributable to Alexandria’s common stockholders: |

|||||||

|

1Q25 |

1Q24 |

1Q25 |

1Q24 |

||||

|

(in millions, except per share amounts) |

Amount |

Per Share – Diluted |

|||||

|

Unrealized (losses) gains on non-real estate investments |

$ (68.1) |

$ 29.2 |

$ (0.40) |

$ 0.17 |

|||

|

Gain on sales of real estate |

13.2 |

0.4 |

0.08 |

— |

|||

|

Impairment of non-real estate investments |

(11.2) |

(14.7) |

(0.07) |

(0.09) |

|||

|

Impairment of real estate(1) |

(32.2) |

— |

(0.19) |

— |

|||

|

Increase in provision for expected credit losses on financial instruments(1) |

(0.3) |

— |

— |

— |

|||

|

Total |

$ (98.6) |

$ 14.9 |

$ (0.58) |

$ 0.08 |

|||

|

(1) |

Refer to “Funds from operations and funds from operations per share” in the Earnings Press Release for additional details. |

Subsequent event

- In April 2025, an office property aggregating 182,276 RSF located in Carlsbad, San Diego met the criteria for classification as held for sale based on current negotiations with the prospective buyer and our decision to dispose of this property for an estimated sales price of approximately $72.0 million. We expect to complete the sale within 12 months. Upon our decision to commit to sell this property, we recognized an impairment charge of $35.4 million to reduce the carrying amount of this asset to its estimated fair value less costs to sell.

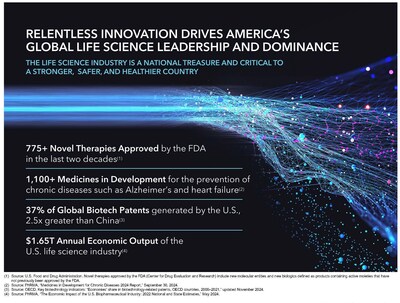

Industry and corporate responsibility leadership: catalyzing and leading the way for positive change to benefit human health and society

- Alexandria was named one of the Most Trustworthy Companies in America by Newsweek for the third consecutive year based on customer, investor, and employee trust. Alexandria is one of only four S&P 500 REITs recognized in the real estate and housing category.

- During 1Q25, we received broad recognition for our operational excellence in leasing, design, development, and asset management. Significant honors included the following:

- In our San Francisco Bay Area market, we earned a San Francisco Business Times 2024 Real Estate Deals of the Year Award for our 258,581 RSF long-term lease with Vaxcyte, Inc. at 825 Industrial Road on the Alexandria Center® for Life Science – San Carlos Megacampus.

- Alexandria earned two BOMA (Building Owners and Managers Association) TOBY (The Outstanding Building of the Year) Awards in the Life Science category. The TOBY Awards are the commercial real estate industry’s highest recognition honoring excellence in commercial building management and operations.

- 201 Haskins Way on the Alexandria Center® for Life Science – South San Francisco campus in the San Francisco Bay Area was recognized by BOMA San Francisco.

- 9605 Medical Center Drive on the Alexandria Center® for Life Science – Shady Grove Megacampus in Maryland was recognized by local BOMA affiliate Apartment and Office Building Association of Metropolitan Washington (AOBA).

About Alexandria Real Estate Equities, Inc.

Alexandria Real Estate Equities, Inc. ARE, an S&P 500® company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world. With our founding in 1994, Alexandria pioneered the life science real estate niche. Alexandria is the preeminent and longest-tenured owner, operator, and developer of collaborative Megacampus™ ecosystems in AAA life science innovation cluster locations, including Greater Boston, the San Francisco Bay Area, San Diego, Seattle, Maryland, Research Triangle, and New York City. As of March 31, 2025, Alexandria has a total market capitalization of $28.8 billion and an asset base in North America that includes 39.6 million RSF of operating properties and 4.0 million RSF of Class A/A+ properties undergoing construction. Alexandria has a longstanding and proven track record of developing Class A/A+ properties clustered in highly dynamic and collaborative Megacampus environments that enhance our tenants’ ability to successfully recruit and retain world-class talent and inspire productivity, efficiency, creativity, and success. Alexandria also provides strategic capital to transformative life science companies through our venture capital platform. We believe our unique business model and diligent underwriting ensure a high-quality and diverse tenant base that results in higher occupancy levels, longer lease terms, higher rental income, higher returns, and greater long-term asset value. For more information on Alexandria, please visit www.are.com.

|

Guidance

|

|

Guidance for 2025 has been updated to reflect our current view of existing market conditions and assumptions for the year ending December 31, 2025. There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Our guidance for 2025 is subject to a number of variables and uncertainties, including actions and changes in policy by the current U.S. administration related to the regulatory environment, life science funding, the U.S. Food and Drug Administration and National Institutes of Health, trade, and other areas. For additional discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated, refer to our discussion of “forward-looking statements” in the Earnings Press Release as well

|

|

The midpoint of our guidance range for 2025 funds from operations per share – diluted, as adjusted, was reduced by seven cents, or 75 bps. Key changes to our guidance assumptions include the following:

|

|

Refer to “Key assumptions” and “Key sources and uses of capital.”

|

|

Projected 2025 Earnings per Share and Funds From Operations per Share Attributable to Alexandria’s Common Stockholders – Diluted |

||||||||||

|

As of 4/28/25 |

As of 1/27/25 |

Key Changes to Midpoint |

||||||||

|

Earnings per share(1) |

$1.36 to $1.56 |

$2.57 to $2.77 |

||||||||

|

Depreciation and amortization of real estate assets |

7.05 |

6.70 |

||||||||

|

Gain on sales of real estate |

(0.08) |

— |

(2) |

|||||||

|

Impairment of real estate – rental properties |

0.21 |

— |

(3) |

|||||||

|

Allocation to unvested restricted stock awards |

(0.03) |

(0.04) |

||||||||

|

Funds from operations per share(4) |

$8.51 to $8.71 |

$9.23 to $9.43 |

||||||||

|

Unrealized losses on non-real estate investments |

0.40 |

— |

||||||||

|

Impairment of non-real estate investments |

0.07 |

— |

(4) |

|||||||

|

Impairment of real estate |

0.19 |

— |

||||||||

|

Allocation to unvested restricted stock awards |

(0.01) |

— |

||||||||

|

Funds from operations per share, as adjusted(5) |

$9.16 to $9.36 |

$9.23 to $9.43 |

||||||||

|

Midpoint |

$9.26 |

$9.33 |

Reduction of 7-cents, or 75 bps |

|||||||

|

(1) |

Excludes unrealized gains or losses on non-real estate investments after March 31, 2025 that are required to be recognized in earnings and are excluded from funds from operations per share, as adjusted. |

|

(2) |

Refer to “Dispositions and sales of partial interests” in the Earnings Press Release for additional details. |

|

(3) |

Represents a $35.4 million impairment of real estate recognized in April 2025 related to an office property aggregating 182,276 RSF, located in Carlsbad, San Diego, upon meeting the criteria for classification as held for sale. Refer to “Subsequent events” in the Earnings Press Release for additional details. |

|

(4) |

Refer to “Funds from operations and funds from operations per share” in the Earnings Press Release for additional details. |

|

(5) |

Refer to “Funds from operations and funds from operations, as adjusted, attributable to Alexandria’s common stockholders” under “Definitions and reconciliations” in the Supplemental Information for additional details. |

|

As of 4/28/25 |

As of 1/27/25 |

Key Changes to Midpoint |

|||||||||

|

Key Assumptions |

Low |

High |

Low |

High |

|||||||

|

Occupancy percentage in North America as of December 31, 2025 |

90.9 % |

92.5 % |

91.6 % |

93.2 % |

70 bps reduction |

||||||

|

Lease renewals and re-leasing of space: |

|||||||||||

|

Rental rate changes |

9.0 % |

17.0 % |

9.0 % |

17.0 % |

No change |

||||||

|

Rental rate changes (cash basis) |

0.5 % |

8.5 % |

0.5 % |

8.5 % |

|||||||

|

Same property performance: |

|||||||||||

|

Net operating income |

(3.7) % |

(1.7) % |

(3.0) % |

(1.0) % |

70 bps reduction |

||||||

|

Net operating income (cash basis) |

(1.2) % |

0.8 % |

(1.0) % |

1.0 % |

20 bps reduction |

||||||

|

Straight-line rent revenue |

$ 96 |

$ 116 |

$ 111 |

$ 131 |

$15 million reduction |

||||||

|

General and administrative expenses |

$ 112 |

$ 127 |

$ 129 |

$ 144 |

$17 million reduction |

||||||

|

Capitalization of interest |

$ 320 |

$ 350 |

$ 340 |

$ 370 |

$20 million reduction |

||||||

|

Interest expense |

$ 185 |

$ 215 |

$ 165 |

$ 195 |

$20 million increase |

||||||

|

Realized gains on non-real estate investments(1) |

$ 100 |

$ 130 |

$ 100 |

$ 130 |

No change |

||||||

|

Key Credit Metrics Targets |

As of 4/28/25 |

As of 1/27/25 |

Key Changes |

|||

|

Net debt and preferred stock to Adjusted EBITDA – 4Q25 annualized |

Less than or equal to 5.2x |

Less than or equal to 5.2x |

No change |

|||

|

Fixed-charge coverage ratio – 4Q25 annualized |

4.0x to 4.5x |

4.0x to 4.5x |

||||

|

As of 4/28/25 |

As of 1/27/25 Midpoint |

Key Changes to Midpoint |

||||||||||||

|

Key Sources and Uses of Capital |

Range |

Midpoint |

Certain Completed Items |

|||||||||||

|

Sources of capital: |

||||||||||||||

|

Net reduction in debt |

$ (290) |

$ (290) |

$ (290) |

See below |

$ (190) |

See below |

||||||||

|

Net cash provided by operating activities after dividends(2) |

425 |

525 |

475 |

475 |

||||||||||

|

Dispositions and sales of partial interests |

1,450 |

2,450 |

1,950 |

(3) |

1,700 |

$250 million increase(4) |

||||||||

|

Total sources of capital |

$ 1,585 |

$ 2,685 |

$ 2,135 |

$ 1,985 |

||||||||||

|

Uses of capital: |

||||||||||||||

|

Construction |

$ 1,450 |

$ 2,050 |

$ 1,750 |

$ 1,750 |

||||||||||

|

Acquisitions and other opportunistic uses of capital |

— |

500 |

250 |

$ 208 |

(5) |

100 |

$150 million increase(4) |

|||||||

|

Ground lease prepayment |

135 |

135 |

135 |

$ 135 |

135 |

|||||||||

|

Total uses of capital |

$ 1,585 |

$ 2,685 |

$ 2,135 |

$ 1,985 |

||||||||||

|

Net reduction in debt (included above): |

||||||||||||||

|

Issuance of unsecured senior notes payable |

$ 550 |

$ 550 |

$ 550 |

$ 550 |

$ 600 |

|||||||||

|

Repayment of unsecured notes payable(6) |

(600) |

(600) |

(600) |

(600) |

||||||||||

|

Unsecured senior line of credit, commercial paper, and other |

(240) |

(240) |

(240) |

(190) |

||||||||||

|

Net reduction in debt |

$ (290) |

$ (290) |

$ (290) |

$ (190) |

$100 million reduction |

|||||||||

|

(1) |

Represents realized gains and losses included in funds from operations per share – diluted, as adjusted, and excludes significant impairments realized on non-real estate investments, if any. Refer to “Investments” in the Supplemental Information for additional details. |

|

|

(2) |

Excludes the final installment of our ground lease payment aggregating $135.0 million at the Alexandria Technology Square® Megacampus. This amount has been separately presented as “Ground lease prepayment” under “Uses of capital” in the table above. |

|

|

(3) |

As of April 28, 2025, completed dispositions aggregated $176.4 million and our share of pending transactions subject to non-refundable deposits, signed letters of intent, or purchase and sale agreement negotiations aggregated $432.5 million. As part of a completed transaction, we provided seller financing of $91.0 million. Refer to “Dispositions and sales of partial interests” in the Earnings Press Release for additional details. |

|

|

(4) |

The increase to the midpoint of our guidance range for 2025 dispositions and sales of partial interests is primarily due to an increase in the midpoint of our guidance range for 2025 acquisitions and other opportunistic uses of capital by $150 million. |

|

|

(5) |

Under our common stock repurchase program authorized in December 2024, we may repurchase up to $500.0 million of our common stock through December 31, 2025. During 1Q25, we repurchased 2.2 million shares of common stock for an aggregate value of $208.1 million at an average price per share of $96.71. As of April 28, 2025, the approximate value of shares authorized and remaining under this program was $241.8 million. Subject to market conditions, we may consider repurchasing additional shares of our common stock. |

|

|

(6) |

Upon maturity on April 30, 2025, we expect to repay $600.0 million of our 3.45% unsecured senior notes payable. |

|

Dispositions and Sales of Partial Interests |

|||||||||||||

|

Property |

Submarket/Market |

Date of Sale |

Interest Sold |

Future Development RSF |

Sales Price |

Gain on Sales of Real Estate |

|||||||

|

Completed in 1Q25: |

|||||||||||||

|

Land and other |

|||||||||||||

|

Costa Verde by Alexandria |

University Town Center/San Diego |

1/31/25 |

100 % |

537,000 |

$ 124,000 |

(1) |

$ — |

||||||

|

Other |

52,352 |

13,165 |

|||||||||||

|

176,352 |

$ 13,165 |

||||||||||||

|

Our share of pending 2025 dispositions and sales of partial interests expected to close subsequent to April 28, 2025: |

|||||||||||||

|

Subject to non-refundable deposits: |

|||||||||||||

|

Pending |

San Diego |

2H25 |

100 % |

70,000 |

|||||||||

|

Pending |

Texas |

2Q25 |

100 % |

73,287 |

|||||||||

|

Other |

63,000 |

||||||||||||

|

206,287 |

|||||||||||||

|

Subject to executed letters of intent and/or purchase and sale agreement negotiations |

226,250 |

||||||||||||

|

Our share of completed and pending 2025 dispositions and sales of partial interests |

$ 608,889 |

||||||||||||

|

2025 guidance range for dispositions and sales of partial interests |

$1,450,000 – $2,450,000 |

||||||||||||

|

(1) |

As part of the transaction, we provided seller financing of $91.0 million, due in 2028, with an interest rate of 12.0%. |

Earnings Call Information and About the Company

March 31, 2025

We will host a conference call on Tuesday, April 29, 2025, at 3:00 p.m. Eastern Time (“ET”)/noon Pacific Time (“PT”), which is open to the general public, to discuss our financial and operating results for the first quarter ended March 31, 2025. To participate in this conference call, dial (833) 366-1125 or (412) 902-6738 shortly before 3:00 p.m. ET/noon PT and ask the operator to join the call for Alexandria Real Estate Equities, Inc. The audio webcast can be accessed at www.are.com in the “For Investors” section. A replay of the call will be available for a limited time from 5:00 p.m. ET/2:00 p.m. PT on Tuesday, April 29, 2025. The replay number is (877) 344-7529 or (412) 317-0088, and the access code is 1950174.

Additionally, a copy of this Earnings Press Release and Supplemental Information for the first quarter ended March 31, 2025 is available in the “For Investors” section of our website at www.are.com or by following this link: https://www.are.com/fs/2025q1.pdf.

For any questions, please contact corporateinformation@are.com; Joel S. Marcus, executive chairman and founder; Peter M. Moglia, chief executive officer and chief investment officer; Marc E. Binda, chief financial officer and treasurer; or Paula Schwartz, managing director of Rx Communications Group, at (917) 633-7790.

About the Company

Alexandria Real Estate Equities, Inc. ARE, an S&P 500® company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world. With our founding in 1994, Alexandria pioneered the life science real estate niche. Alexandria is the preeminent and longest-tenured owner, operator, and developer of collaborative Megacampus™ ecosystems in AAA life science innovation cluster locations, including Greater Boston, the San Francisco Bay Area, San Diego, Seattle, Maryland, Research Triangle, and New York City. As of March 31, 2025, Alexandria has a total market capitalization of $28.8 billion and an asset base in North America that includes 39.6 million RSF of operating properties and 4.0 million RSF of Class A/A+ properties undergoing construction. Alexandria has a longstanding and proven track record of developing Class A/A+ properties clustered in highly dynamic and collaborative Megacampus environments that enhance our tenants’ ability to successfully recruit and retain world-class talent and inspire productivity, efficiency, creativity, and success. Alexandria also provides strategic capital to transformative life science companies through our venture capital platform. We believe our unique business model and diligent underwriting ensure a high-quality and diverse tenant base that results in higher occupancy levels, longer lease terms, higher rental income, higher returns, and greater long-term asset value. For more information on Alexandria, please visit www.are.com.

Forward-Looking Statements

This document includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding our projected 2025 earnings per share, projected 2025 funds from operations per share, projected 2025 funds from operations per share, as adjusted, projected net operating income, and our projected sources and uses of capital. You can identify the forward-looking statements by their use of forward-looking words, such as “forecast,” “guidance,” “goals,” “projects,” “estimates,” “anticipates,” “believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,” “targets,” or “will,” or the negative of those words or similar words. These forward-looking statements are based on our current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. There can be no assurance that actual results will not be materially higher or lower than these expectations. These statements are subject to risks, uncertainties, assumptions, and other important factors that could cause actual results to differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, without limitation, our failure to obtain capital (debt, construction financing, and/or equity) or refinance debt maturities, lower than expected yields, increased interest rates and operating costs, adverse economic or real estate developments in our markets, our failure to successfully place into service and lease any properties undergoing development or redevelopment and our existing space held for future development or redevelopment (including new properties acquired for that purpose), our failure to successfully operate or lease acquired properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, defaults on or non-renewal of leases by tenants, adverse general and local economic conditions, an unfavorable capital market environment, decreased leasing activity or lease renewals, failure to obtain LEED and other healthy building certifications and efficiencies, and other risks and uncertainties detailed in our filings with the Securities and Exchange Commission (“SEC”). Accordingly, you are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are made as of the date of this Earnings Press Release and Supplemental Information, and unless otherwise stated, we assume no obligation to update this information and expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in our forward-looking statements, and risks to our business in general, please refer to our SEC filings, including our most recent annual report on Form 10-K and any subsequent quarterly reports on Form 10-Q.

This document is not an offer to sell or a solicitation to buy securities of Alexandria Real Estate Equities, Inc. Any offers to sell or solicitations to buy our securities shall be made only by means of a prospectus approved for that purpose. Unless otherwise indicated, the “Company,” “Alexandria,” “ARE,” “we,” “us,” and “our” refer to Alexandria Real Estate Equities, Inc. and our consolidated subsidiaries. Alexandria®, Lighthouse Design® logo, Building the Future of Life-Changing Innovation®, That’s What’s in Our DNA®, Megacampus™, Labspace®, Alexandria Summit®, At the Vanguard and Heart of the Life Science Ecosystem™, Alexandria Center®, Alexandria Technology Square®, Alexandria Technology Center®, and Alexandria Innovation Center® are copyrights and trademarks of Alexandria Real Estate Equities, Inc. All other company names, trademarks, and logos referenced herein are the property of their respective owners.

|

Consolidated Statements of Operations

|

||||||||||

|

Three Months Ended |

||||||||||

|

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

|

Revenues: |

||||||||||

|

Income from rentals |

$ 743,175 |

(1) |

$ 763,249 |

$ 775,744 |

$ 755,162 |

$ 755,551 |

||||

|

Other income |

14,983 |

25,696 |

15,863 |

11,572 |

13,557 |

|||||

|

Total revenues |

758,158 |

788,945 |

791,607 |

766,734 |

769,108 |

|||||

|

Expenses: |

||||||||||

|

Rental operations |

226,395 |

240,432 |

233,265 |

217,254 |

218,314 |

|||||

|

General and administrative |

30,675 |

32,730 |

43,945 |

44,629 |

47,055 |

|||||

|

Interest |

50,876 |

55,659 |

43,550 |

45,789 |

40,840 |

|||||

|

Depreciation and amortization |

342,062 |

330,108 |

293,998 |

290,720 |

287,554 |

|||||

|

Impairment of real estate |

32,154 |

186,564 |

5,741 |

30,763 |

— |

|||||

|

Total expenses |

682,162 |

845,493 |

620,499 |

629,155 |

593,763 |

|||||

|

Equity in (losses) earnings of unconsolidated real estate joint ventures |

(507) |

6,635 |

139 |

130 |

155 |

|||||

|

Investment (loss) income |

(49,992) |

(67,988) |

15,242 |

(43,660) |

43,284 |

|||||

|

Gain on sales of real estate |

13,165 |

101,806 |

27,114 |

— |

392 |

|||||

|

Net income (loss) |

38,662 |

(16,095) |

213,603 |

94,049 |

219,176 |

|||||

|

Net income attributable to noncontrolling interests |

(47,601) |

(46,150) |

(45,656) |

(47,347) |

(48,631) |

|||||

|

Net (loss) income attributable to Alexandria Real Estate Equities, Inc.’s stockholders |

(8,939) |

(62,245) |

167,947 |

46,702 |

170,545 |

|||||

|

Net income attributable to unvested restricted stock awards |

(2,660) |

(2,677) |

(3,273) |

(3,785) |

(3,659) |

|||||

|

Net (loss) income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders |

$ (11,599) |

$ (64,922) |

$ 164,674 |

$ 42,917 |

$ 166,886 |

|||||

|

Net (loss) income per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders: |

||||||||||

|

Basic |

$ (0.07) |

$ (0.38) |

$ 0.96 |

$ 0.25 |

$ 0.97 |

|||||

|

Diluted |

$ (0.07) |

$ (0.38) |

$ 0.96 |

$ 0.25 |

$ 0.97 |

|||||

|

Weighted-average shares of common stock outstanding: |

||||||||||

|

Basic |

170,522 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

|

Diluted |

170,522 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

|

Dividends declared per share of common stock |

$ 1.32 |

$ 1.32 |

$ 1.30 |

$ 1.30 |

$ 1.27 |

|||||

|

(1) |

Decline in income from rentals relates primarily to $1.1 billion of dispositions completed during 4Q24. |

|

Consolidated Balance Sheets

|

||||||||||

|

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

|

Assets |

||||||||||

|

Investments in real estate |

$ 32,121,712 |

$ 32,110,039 |

$ 32,951,777 |

$ 32,673,839 |

$ 32,323,138 |

|||||

|

Investments in unconsolidated real estate joint ventures |

50,086 |

39,873 |

40,170 |

40,535 |

40,636 |

|||||

|

Cash and cash equivalents |

476,430 |

552,146 |

562,606 |

561,021 |

722,176 |

|||||

|

Restricted cash |

7,324 |

7,701 |

17,031 |

4,832 |

9,519 |

|||||

|

Tenant receivables |

6,875 |

6,409 |

6,980 |

6,822 |

7,469 |

|||||

|

Deferred rent |

1,210,584 |

1,187,031 |

1,216,176 |

1,190,336 |

1,138,936 |

|||||

|

Deferred leasing costs |

489,287 |

485,959 |

516,872 |

519,629 |

520,616 |

|||||

|

Investments |

1,479,688 |

1,476,985 |

1,519,327 |

1,494,348 |

1,511,588 |

|||||

|

Other assets |

1,758,442 |

1,661,306 |

1,657,189 |

1,356,503 |

1,424,968 |

|||||

|

Total assets |

$ 37,600,428 |

$ 37,527,449 |

$ 38,488,128 |

$ 37,847,865 |

$ 37,699,046 |

|||||

|

Liabilities, Noncontrolling Interests, and Equity |

||||||||||

|

Secured notes payable |

$ 150,807 |

$ 149,909 |

$ 145,000 |

$ 134,942 |

$ 130,050 |

|||||

|

Unsecured senior notes payable |

12,640,144 |

12,094,465 |

12,092,012 |

12,089,561 |

12,087,113 |

|||||

|

Unsecured senior line of credit and commercial paper |

299,883 |

— |

454,589 |

199,552 |

— |

|||||

|

Accounts payable, accrued expenses, and other liabilities |

2,281,414 |

2,654,351 |

2,865,886 |

2,529,535 |

2,503,831 |

|||||

|

Dividends payable |

228,622 |

230,263 |

227,191 |

227,408 |

222,134 |

|||||

|

Total liabilities |

15,600,870 |

15,128,988 |

15,784,678 |

15,180,998 |

14,943,128 |

|||||

|

Commitments and contingencies |

||||||||||

|

Redeemable noncontrolling interests |

9,612 |

19,972 |

16,510 |

16,440 |

16,620 |

|||||

|

Alexandria Real Estate Equities, Inc.’s stockholders’ equity: |

||||||||||

|

Common stock |

1,701 |

1,722 |

1,722 |

1,720 |

1,720 |

|||||

|

Additional paid-in capital |

17,509,148 |

17,933,572 |

18,238,438 |

18,284,611 |

18,434,690 |

|||||

|

Accumulated other comprehensive loss |

(46,202) |

(46,252) |

(22,529) |

(27,710) |

(23,815) |

|||||

|

Alexandria Real Estate Equities, Inc.’s stockholders’ equity |

17,464,647 |

17,889,042 |

18,217,631 |

18,258,621 |

18,412,595 |

|||||

|

Noncontrolling interests |

4,525,299 |

4,489,447 |

4,469,309 |

4,391,806 |

4,326,703 |

|||||

|

Total equity |

21,989,946 |

22,378,489 |

22,686,940 |

22,650,427 |

22,739,298 |

|||||

|

Total liabilities, noncontrolling interests, and equity |

$ 37,600,428 |

$ 37,527,449 |

$ 38,488,128 |

$ 37,847,865 |

$ 37,699,046 |

|||||

|

Funds From Operations and Funds From Operations per Share

|

|

The following table presents a reconciliation of net income (loss) attributable to Alexandria’s common stockholders, the most directly comparable financial measure presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including our share of amounts from consolidated and unconsolidated real estate joint ventures, to funds from operations attributable to Alexandria’s common stockholders – diluted, and funds from operations attributable to Alexandria’s common stockholders – diluted, as adjusted, for the periods below:

|

|

Three Months Ended |

||||||||||

|

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

|

Net (loss) income attributable to Alexandria’s common stockholders – basic and diluted |

$ (11,599) |

$ (64,922) |

$ 164,674 |

$ 42,917 |

$ 166,886 |

|||||

|

Depreciation and amortization of real estate assets |

339,381 |

327,198 |

291,258 |

288,118 |

284,950 |

|||||

|

Noncontrolling share of depreciation and amortization from consolidated real estate JVs |

(33,411) |

(34,986) |

(32,457) |

(31,364) |

(30,904) |

|||||

|

Our share of depreciation and amortization from unconsolidated real estate JVs |

1,054 |

1,061 |

1,075 |

1,068 |

1,034 |

|||||

|

Gain on sales of real estate |

(13,165) |

(100,109) |

(27,114) |

— |

(392) |

|||||

|

Impairment of real estate – rental properties and land |

— |

184,532 |

5,741 |

2,182 |

— |

|||||

|

Allocation to unvested restricted stock awards |

(686) |

(1,182) |

(2,908) |

(1,305) |

(3,469) |

|||||

|

Funds from operations attributable to Alexandria’s common stockholders – diluted(1) |

281,574 |

311,592 |

400,269 |

301,616 |

418,105 |

|||||

|

Unrealized losses (gains) on non-real estate investments |

68,145 |

79,776 |

(2,610) |

64,238 |

(29,158) |

|||||

|

Impairment of non-real estate investments |

11,180 |

(2) |

20,266 |

10,338 |

12,788 |

14,698 |

||||

|

Impairment of real estate |

32,154 |

(3) |

2,032 |

— |

28,581 |

— |

||||

|

Increase (decrease) in provision for expected credit losses on financial instruments |

285 |

(434) |

— |

— |

— |

|||||

|

Allocation to unvested restricted stock awards |

(1,329) |

(1,407) |

(125) |

(1,738) |

247 |

|||||

|

Funds from operations attributable to Alexandria’s common stockholders – diluted, as adjusted |

$ 392,009 |

$ 411,825 |

$ 407,872 |

$ 405,485 |

$ 403,892 |

|||||

|

Refer to “Definitions and reconciliations” in the Supplemental Information for additional details. |

|

|

(1) |

Calculated in accordance with standards established by the Nareit Board of Governors. |

|

(2) |

Primarily related to four non-real estate investments in privately held entities that do not report NAV. |

|

(3) |

In 2021, we entered into a ground lease for a future development site in our San Francisco Bay Area market. As of December 31, 2024, we had a right-of-use-asset aggregating $32.4 million related to our investment into this ground lease. During the three months ended March 31, 2025, based on our current financial outlook for this project, we made the determination to no longer proceed with this project. Consequently, we recognized an impairment charge aggregating $32.2 million to write off our remaining balance in this right-of-use asset. We do not expect to make additional future payments in connection with this project. |

|

March 31, 2025

|

|

The following table presents a reconciliation of net income (loss) per share attributable to Alexandria’s common stockholders, the most directly comparable financial measure presented in accordance with GAAP, including our share of amounts from consolidated and unconsolidated real estate joint ventures, to funds from operations per share attributable to Alexandria’s common stockholders – diluted, and funds from operations per share attributable to Alexandria’s common stockholders – diluted, as adjusted, for the periods below. Per share amounts may not add due to rounding. |

|

Three Months Ended |

||||||||||

|

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

|

Net (loss) income per share attributable to Alexandria’s common stockholders – diluted |

$ (0.07) |

$ (0.38) |

$ 0.96 |

$ 0.25 |

$ 0.97 |

|||||

|

Depreciation and amortization of real estate assets |

1.80 |

1.70 |

1.51 |

1.50 |

1.48 |

|||||

|

Gain on sales of real estate |

(0.08) |

(0.58) |

(0.16) |

— |

— |

|||||

|

Impairment of real estate – rental properties and land |

— |

1.07 |

0.03 |

0.01 |

— |

|||||

|

Allocation to unvested restricted stock awards |

— |

— |

(0.01) |

(0.01) |

(0.02) |

|||||

|

Funds from operations per share attributable to Alexandria’s common stockholders – diluted |

1.65 |

1.81 |

2.33 |

1.75 |

2.43 |

|||||

|

Unrealized losses (gains) on non-real estate investments |

0.40 |

0.46 |

(0.02) |

0.37 |

(0.17) |

|||||

|

Impairment of non-real estate investments |

0.07 |

0.12 |

0.06 |

0.08 |

0.09 |

|||||

|

Impairment of real estate |

0.19 |

0.01 |

— |

0.17 |

— |

|||||

|

Allocation to unvested restricted stock awards |

(0.01) |

(0.01) |

— |

(0.01) |

— |

|||||

|

Funds from operations per share attributable to Alexandria’s common stockholders – diluted, as adjusted |

$ 2.30 |

$ 2.39 |

$ 2.37 |

$ 2.36 |

$ 2.35 |

|||||

|

Weighted-average shares of common stock outstanding – diluted |

||||||||||

|

Earnings per share – diluted |

170,522 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

|

Funds from operations – diluted, per share |

170,599 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

|

Funds from operations – diluted, as adjusted, per share |

170,599 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

|

Refer to “Definitions and reconciliations” in the Supplemental Information for additional details. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-reports-1q25-net-loss-per-share–diluted-of-0-07-and-1q25-ffo-per-share–diluted-as-adjusted-of-2-30–302440057.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-reports-1q25-net-loss-per-share–diluted-of-0-07-and-1q25-ffo-per-share–diluted-as-adjusted-of-2-30–302440057.html

SOURCE Alexandria Real Estate Equities, Inc.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment