Whales with a lot of money to spend have taken a noticeably bearish stance on Delta Air Lines.

Looking at options history for Delta Air Lines DAL we detected 37 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 62% with bearish.

From the overall spotted trades, 23 are puts, for a total amount of $2,058,970 and 14, calls, for a total amount of $1,413,825.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $23.0 to $60.0 for Delta Air Lines during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Delta Air Lines options trades today is 2203.53 with a total volume of 17,835.00.

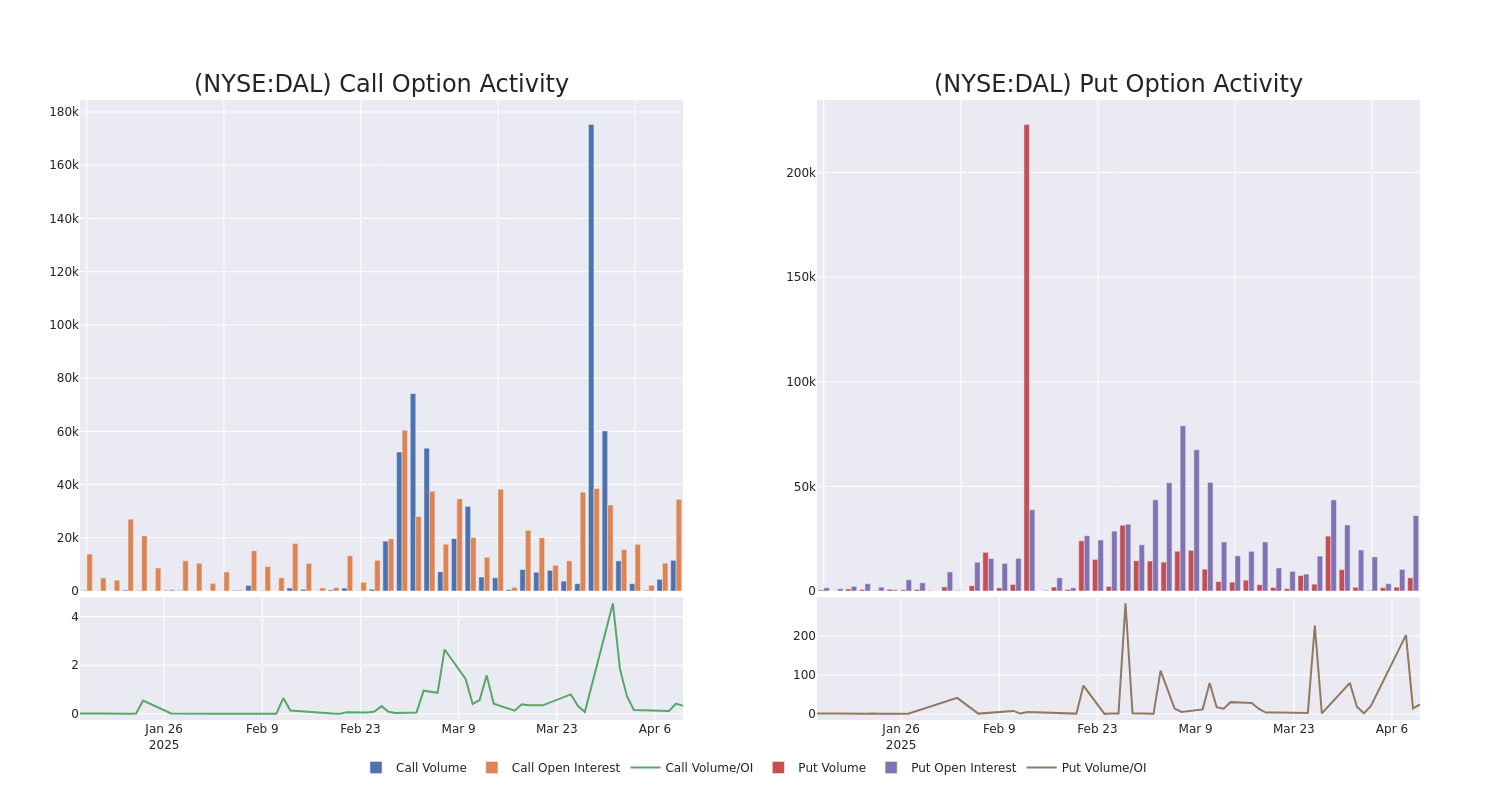

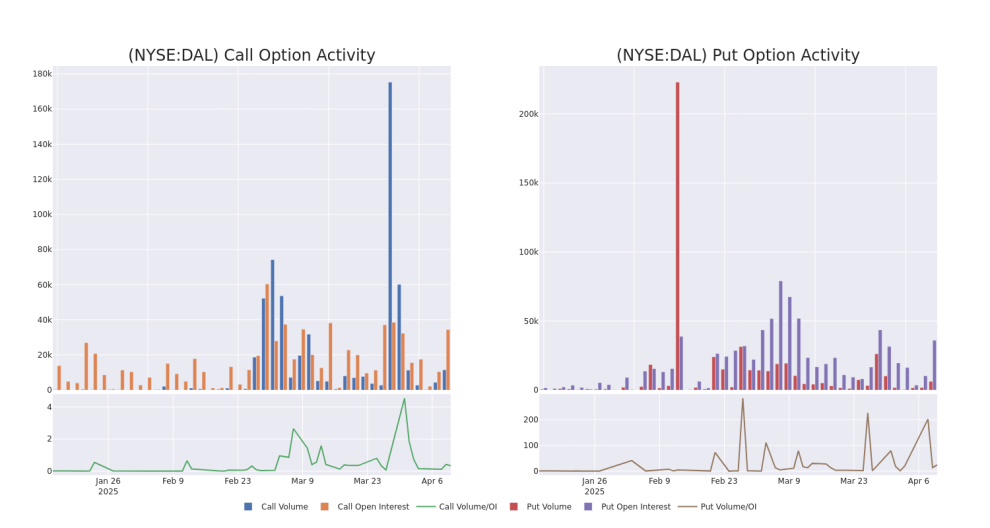

In the following chart, we are able to follow the development of volume and open interest of call and put options for Delta Air Lines’s big money trades within a strike price range of $23.0 to $60.0 over the last 30 days.

Delta Air Lines 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DAL | PUT | SWEEP | BULLISH | 05/16/25 | $3.75 | $3.65 | $3.66 | $40.00 | $367.0K | 5.7K | 269 |

| DAL | PUT | SWEEP | BULLISH | 06/20/25 | $4.15 | $4.1 | $4.15 | $39.00 | $331.6K | 409 | 825 |

| DAL | CALL | SWEEP | BEARISH | 06/20/25 | $1.37 | $1.36 | $1.37 | $48.00 | $312.2K | 240 | 2.5K |

| DAL | PUT | SWEEP | BEARISH | 06/20/25 | $6.6 | $6.5 | $6.6 | $45.00 | $198.0K | 5.5K | 318 |

| DAL | CALL | SWEEP | BEARISH | 04/17/25 | $2.48 | $2.25 | $2.25 | $40.00 | $182.0K | 2.3K | 1.9K |

About Delta Air Lines

Atlanta-based Delta Air Lines is one of the world’s largest airlines, with a network of over 300 destinations in more than 50 countries. Delta operates a hub-and-spoke network, where it gathers and distributes passengers across the globe through its biggest hubs in Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul. Delta has historically earned most of its international revenue and profits from flying passengers over the Atlantic Ocean.

Following our analysis of the options activities associated with Delta Air Lines, we pivot to a closer look at the company’s own performance.

Delta Air Lines’s Current Market Status

- Trading volume stands at 16,619,783, with DAL’s price down by -11.53%, positioned at $39.17.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 91 days.

What Analysts Are Saying About Delta Air Lines

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $59.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Citigroup persists with their Buy rating on Delta Air Lines, maintaining a target price of $72.

* An analyst from B of A Securities has decided to maintain their Buy rating on Delta Air Lines, which currently sits at a price target of $56.

* Maintaining their stance, an analyst from Raymond James continues to hold a Strong Buy rating for Delta Air Lines, targeting a price of $62.

* Reflecting concerns, an analyst from Jefferies lowers its rating to Hold with a new price target of $46.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Delta Air Lines with a target price of $60.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Delta Air Lines options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment