Whales with a lot of money to spend have taken a noticeably bearish stance on Celsius Holdings.

Looking at options history for Celsius Holdings CELH we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $302,702 and 3, calls, for a total amount of $152,625.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $20.0 and $60.0 for Celsius Holdings, spanning the last three months.

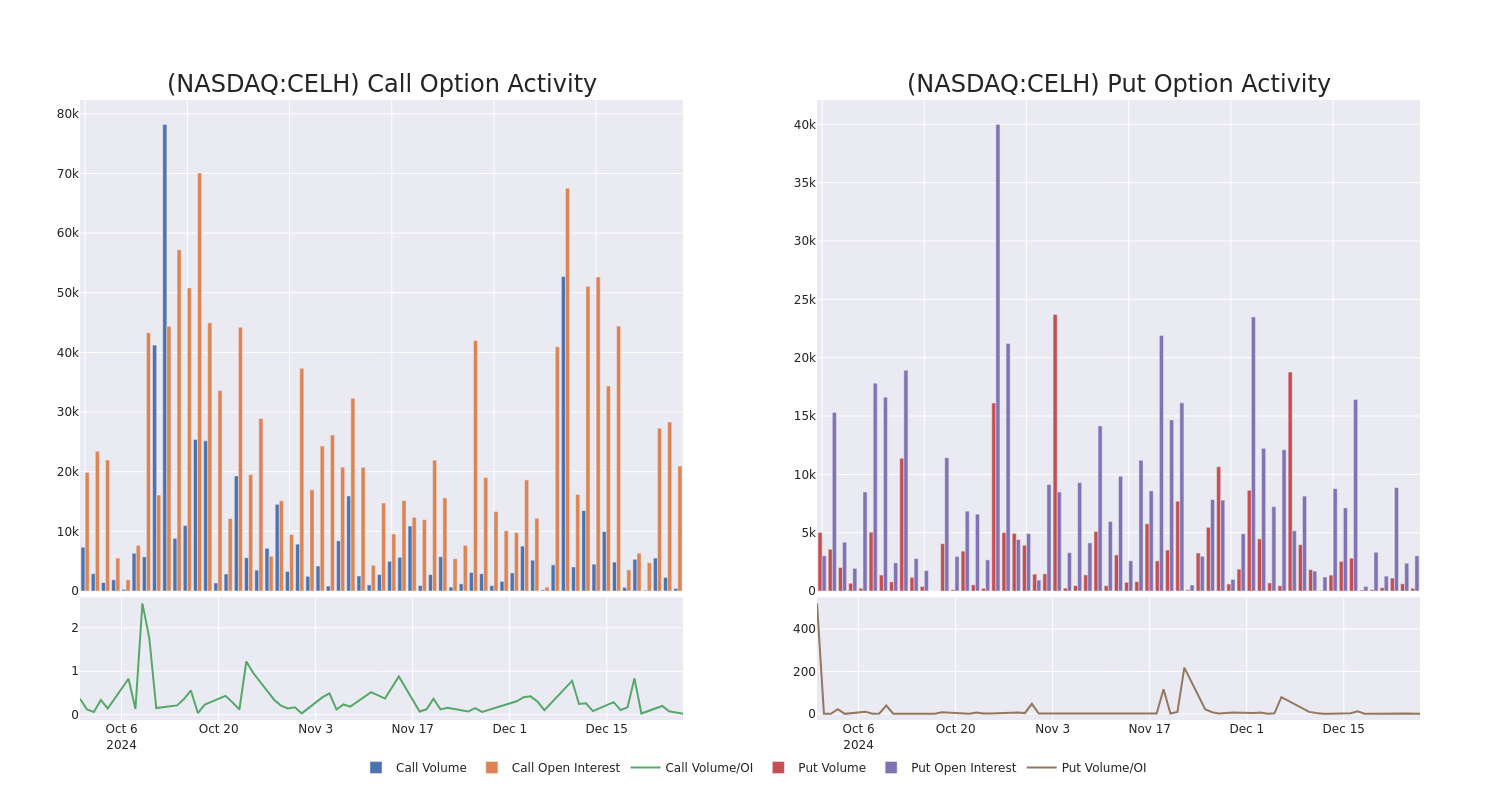

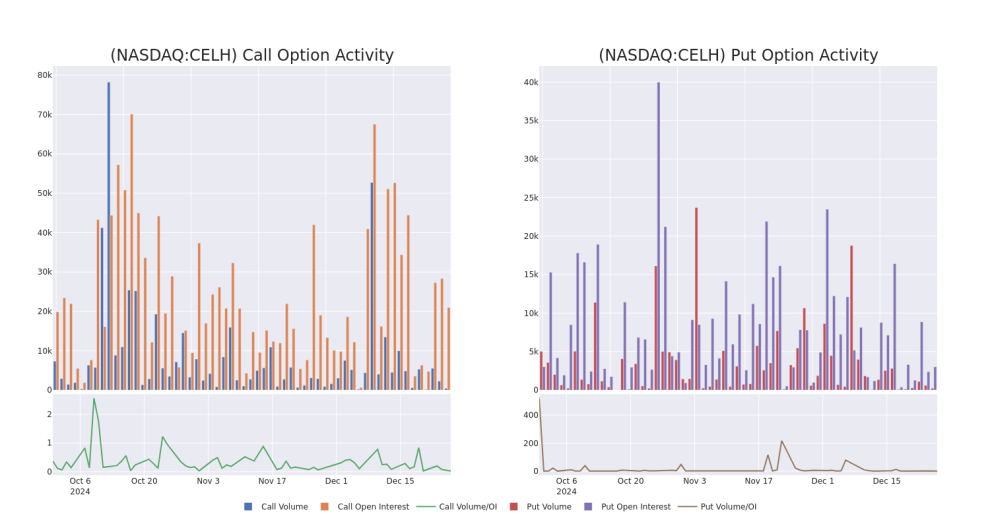

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Celsius Holdings’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Celsius Holdings’s whale activity within a strike price range from $20.0 to $60.0 in the last 30 days.

Celsius Holdings Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | PUT | SWEEP | NEUTRAL | 06/20/25 | $33.75 | $32.3 | $32.9 | $60.00 | $164.5K | 802 | 50 |

| CELH | CALL | TRADE | BULLISH | 01/17/25 | $8.0 | $7.4 | $7.8 | $20.00 | $78.0K | 15.5K | 100 |

| CELH | PUT | TRADE | BEARISH | 06/20/25 | $33.15 | $32.45 | $32.91 | $60.00 | $42.7K | 802 | 64 |

| CELH | CALL | SWEEP | NEUTRAL | 01/15/27 | $11.45 | $11.15 | $11.3 | $27.50 | $38.4K | 361 | 50 |

| CELH | PUT | TRADE | BEARISH | 06/20/25 | $33.15 | $32.45 | $32.93 | $60.00 | $36.2K | 802 | 75 |

About Celsius Holdings

Celsius Holdings plays in the energy drink subsegment of the global nonalcoholic beverage market, with 96% of revenue concentrated in North America. Celsius’ products contain natural ingredients and a metabolism-enhancing formulation, appealing to fitness and active lifestyle enthusiasts. The firm’s portfolio includes its namesake Celsius Originals beverages, Celsius Essentials line (containing aminos), and Celsius On-the-Go powder packets. Celsius dedicates its efforts to branding and innovation, while it utilizes third parties for the manufacturing, packaging, and distribution of its products. In 2022, Celsius forged a 20-year distribution agreement with PepsiCo, which holds an 8.5% stake in the business.

Current Position of Celsius Holdings

- Trading volume stands at 1,083,259, with CELH’s price down by -0.18%, positioned at $27.31.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 63 days.

Expert Opinions on Celsius Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $37.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Needham downgraded its action to Buy with a price target of $38.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Celsius Holdings, maintaining a target price of $42.

* An analyst from JP Morgan downgraded its action to Overweight with a price target of $37.

* An analyst from Deutsche Bank downgraded its action to Hold with a price target of $32.

* Maintaining their stance, an analyst from Roth MKM continues to hold a Buy rating for Celsius Holdings, targeting a price of $38.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Celsius Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment